imprimermonlivre.ru Prices

Prices

Business Checking Account Bonus

Open a Business Choice Checking® account and receive a $ bonus with a minimum deposit of $20, in new money within 30 days of account opening. Also, must. Open a business bank account. Find the right accounts and packages that best Take advantage of our partners' special offers to make your day-to-day business. You may earn a $ or $1, reward if you open a new PNC Treasury Enterprise Plan or Analysis Business Checking account. How to Get Business Account Bonuses · Chase Business Complete Banking®: $ Bonus · Bank of America® Business Advantage Banking Checking Account: $ Bonus. A straightforward checking account that offers a variety of benefits, features, and online tools to track your finances, make payments, and transfer funds. To receive the $ checking bonus, open a new business checking account, deposit $50 or more at account opening, and have at least a $3, balance 90 days. Open a new eligible Bank of America business checking account and qualify for a $ cash bonus offer · A business checking account gives you the tools you need. Open a Business Access Checking® account and receive a $ bonus with a minimum deposit of $2, in new money within 30 days of account opening. Also, must. Take advantage of Huntington Bank's business checking account promotions and bonuses to earn up to $ Apply online or visit a branch today. Open a Business Choice Checking® account and receive a $ bonus with a minimum deposit of $20, in new money within 30 days of account opening. Also, must. Open a business bank account. Find the right accounts and packages that best Take advantage of our partners' special offers to make your day-to-day business. You may earn a $ or $1, reward if you open a new PNC Treasury Enterprise Plan or Analysis Business Checking account. How to Get Business Account Bonuses · Chase Business Complete Banking®: $ Bonus · Bank of America® Business Advantage Banking Checking Account: $ Bonus. A straightforward checking account that offers a variety of benefits, features, and online tools to track your finances, make payments, and transfer funds. To receive the $ checking bonus, open a new business checking account, deposit $50 or more at account opening, and have at least a $3, balance 90 days. Open a new eligible Bank of America business checking account and qualify for a $ cash bonus offer · A business checking account gives you the tools you need. Open a Business Access Checking® account and receive a $ bonus with a minimum deposit of $2, in new money within 30 days of account opening. Also, must. Take advantage of Huntington Bank's business checking account promotions and bonuses to earn up to $ Apply online or visit a branch today.

Here are some of the best bank account bonuses that are out there currently and what you need to do to earn them. Promotional Bonus Payment: If you meet all of the Eligibility and Qualifications above, we will post the $ bonus to your account within 2 business days of. RBC Bank Cross Border Business Account · Convert and instantly transfer money for free15 between your RBC Canadian and U.S.-based accounts through Online Banking. New account cash bonus offer available to qualified new business checking customers only. Customer must not have closed a Citadel Business checking account. New or existing business clients with no deposit accounts can earn up to $ to open a new business checking and savings account with offer code: 24BU. New Citibank business checking customers can earn a cash bonus when opening an eligible business checking account with required activities. Learn More. More freedom. Fewer fees. · Business owners get up to $ welcome bonus! · A Business Checking Account That Works for You · Business deposit accounts FDIC insured. Find business banking offers for new business account openings, business credit cards and industry specific bundles here. U.S. Bank Business Checking: $ | Chase Business Complete Checking: $ | American Express Checking: Points. Gold Business Checking Package · $20 or $0 monthly maintenance fee when you meet requirements · free transactions per statement cycle · $ fee for each. New customers can earn $ when opening a business checking account! · Make a minimum of 15 debit card purchases/payments, OR · Have cumulative ACH credits of at. Earn $ when you open a Business Complete Checking ®,1 account. For new business checking customers with qualifying activities. To receive $ Open a new PNC Business Checking or PNC Business Checking Plus account. A qualifying debit card transaction is defined as any debit card. New business checking customers qualify for a bonus in 3 easy steps. New Feature! You can now have your monthly maintenance fee waived. Open an eligible business deposit account for your first business in Canada and receive a $50 bonus which will be credited to your new business deposit account. Grow your small business with the best business bank account for you. BMO has a range of business chequing and savings accounts to fit your size and. Earn $ when you open a new Compak Business Checking account. · Deposit a minimum of $10, in new money within the first 30 days. · Maintain an average. Limit one promotional offer per business and/or address. If your account meets the criteria and remains open and active, we will deposit the earned bonus into. Membership Rewards® points after you · Deposit a total of $5, or more in eligible deposits · Maintain an average account balance of $5, for the next 60 days. Grow your relationship with Legacy Bank and receive a $ bonus when you open a new personal or business checking account. How it Works. discount Apply. Apply.

Professional Highlighting Cap

Colortrak Disposable Highlighting Caps - 24 ct. | Shop Haircolor Essentials products online at SalonCentric professional salon beauty supply. Bobby company Magicap - Professional Highlighting Cap BBMGCP. Explore our collection of DOMPEL Professional Silicone Highlight Caps, perfect for precise hair coloring. Shop reusable, durable caps designed for all hair. Payot Professional Body · Payot Professional Face · Payot Retail - Supreme Highlighting Caps. Highlighting Caps. Skip to products. Salon Reusable Hair Color Cap with Hook and Salon Hair Tools for Women Hair ColoringHighlight Cap Material: The highlight cap is made of silicone material. The hair highlighting cap category encapsulates a whole range of hair styling products suited for both home users or professional hair stylers working at salons. Name brand hair highlighting kits and tipping caps at guaranteed low prices. Huge selection. Public not welcome - For licensed beauty professionals only! Comes with 50 professional double layered disposable highlighting colouring caps, pre-marked with holes & one hook. Close fit highlighting cap with protective. Hair Highlighting Caps() · Revlon Color Effects Frost and Glow Ammonia Free Permanent Hair Color, 20 Blonde · L'Oreal Paris La Petite Frost Hair Highlights. Colortrak Disposable Highlighting Caps - 24 ct. | Shop Haircolor Essentials products online at SalonCentric professional salon beauty supply. Bobby company Magicap - Professional Highlighting Cap BBMGCP. Explore our collection of DOMPEL Professional Silicone Highlight Caps, perfect for precise hair coloring. Shop reusable, durable caps designed for all hair. Payot Professional Body · Payot Professional Face · Payot Retail - Supreme Highlighting Caps. Highlighting Caps. Skip to products. Salon Reusable Hair Color Cap with Hook and Salon Hair Tools for Women Hair ColoringHighlight Cap Material: The highlight cap is made of silicone material. The hair highlighting cap category encapsulates a whole range of hair styling products suited for both home users or professional hair stylers working at salons. Name brand hair highlighting kits and tipping caps at guaranteed low prices. Huge selection. Public not welcome - For licensed beauty professionals only! Comes with 50 professional double layered disposable highlighting colouring caps, pre-marked with holes & one hook. Close fit highlighting cap with protective. Hair Highlighting Caps() · Revlon Color Effects Frost and Glow Ammonia Free Permanent Hair Color, 20 Blonde · L'Oreal Paris La Petite Frost Hair Highlights.

And it also has a hook so it is a highlighting kit without holes in the cap or bleaching without a professional in general. Upvote 3. professional hair highlighting cap salon quality hair for home dyeing long lasting easy to use and gentle on hair at the lowest price at Temu. FREESTYLE Professional Highlighting Cap with Hook This reusable cap is ideal for salon or home use when highlighting or low lightening hair. Choose from our range of hair highlight caps, hair dye caps, and hair colouring nets designed for salon use. Shop professional highlighting caps online. The Micro Strong RP Cap made of Silicone for Wicks is the perfect solution for any head. Made of durable silicone, it is ideal for all types of hair and. Professional by FAMA UniCo Toujours trend Nouvelle Igora Highlighting cap with hook For fine highlights. R Vinyl gloves. Hair Dye Accessories Rubber Highlighting Cap by Efalock Professional ✓ Premium members: 10% off EVERYTHING ✓ 1–3 free samples ✓ Exclusive offers ➤ Buy now! - Comfortable Fit: Made from high-quality, flexible material, the cap provides a snug yet comfortable fit, suitable for all head sizes. - Durable and Reusable. Sibel Lory Highlighting Cap with hook. Fits all head sizes; Excellent coverage. Free hook included. Please note this cap does not have pre-made holes. It is my professional opinion you should not attempt to bleach it yourself again. I immediately wanted to say use an all over color but it's. Dompel Silicone Highlight Hair Cap | Reusable Professional Silicone Cap. Brand New. $ Free shipping. Only 1 left! Salon Care Highlighting Cap is a great tool to use for highlighting hair. The double lining includes a perforated outer liner and a bleed-proof inner liner. The Magicap highlighting cap is the ideal tool for hair stylists to help with highlighting work. Both lightweight and transparent. Stable and secure fit for accurate, professional removal of the strands. No slipping of the cap, no warping of the holes. Heat resistant, even under a. Only if you are a professional and know exactly what you're doing, you can paint high lift powder bleach mixed with 30 volume peroxide. Cap used to select hair strands to create highlighting effects Provides Professional Hairdressing Supplies · Salon Essentials · Hairdressing Sundries. Hair Tools Highlighting Cap. A high quality highlighting cap that is supplied with a metal hook. Achieve salon-quality colored highlights with the Ewinever Professional Reusable Hair Coloring Highlighting Cap. This cap and hook set is. Elevate your hair coloring game with professional-quality highlighting caps from AliExpress. Perfect for both salon experts and home DIY enthusiasts. The easiest method around to highlight or frost your hair for the do-it-yourself individual or the professional stylist is the hair frosting cap.

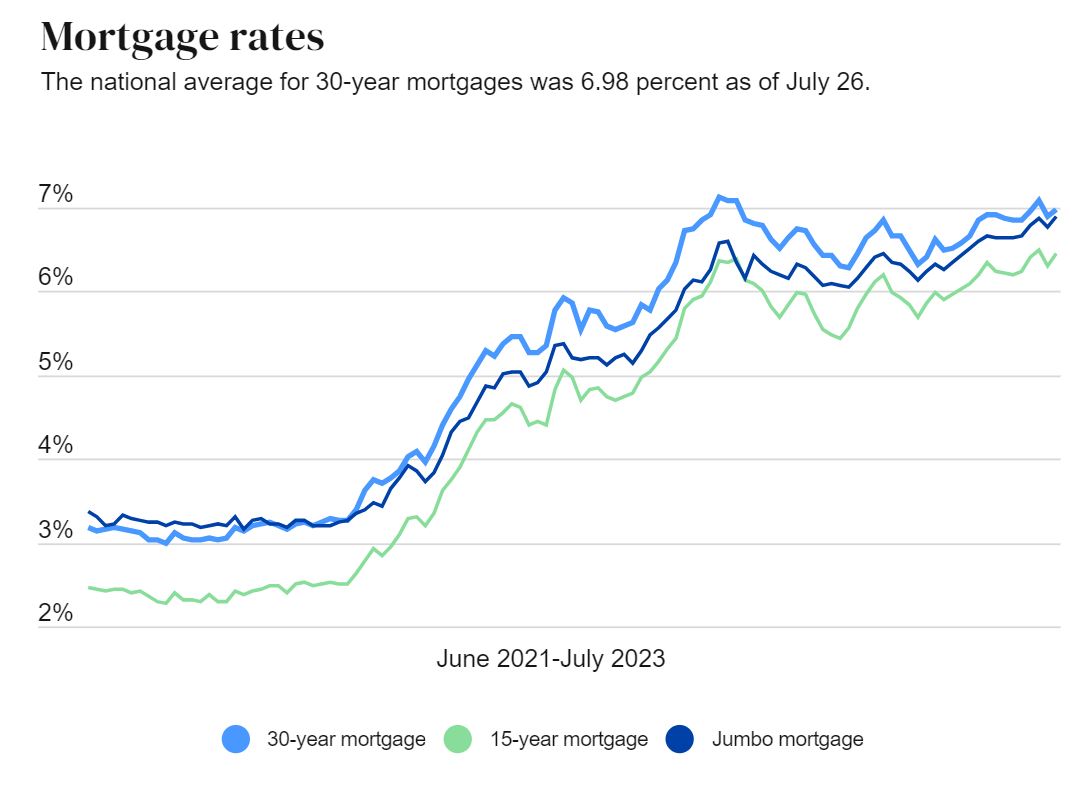

6 Month Interest Rate Forecast

mortgage rates in order to lower their monthly payments. Current Mortgage Rates Data Since xlsx. Opinions, estimates, forecasts, and other views. Fixed Income Analysis (ESR Interest Rate Forecast) of US Interest Rates Single Maturity Forecast. Maturity. 6 Month. 0% 2% 4% 6% 8% Mortgage rate predictions for ; Wells Fargo, % ; Mortgage Bankers Association, % ; Fannie Mae, % ; National Association of Home Builders, %. The latest global economic outlook for from the World Bank. Learn about economic trends, policies, GDP growth, risks, and inflation rates. Forward Curve is the market's projection of LIBOR based on Eurodollar Futures and Swap data. The forward curve is used to price Interest Rate Options. The monthly Economic Outlook includes the Economic Developments Commentary, Economic Forecast, and Housing Forecast – which detail interest rate movement. 5-year daily-updated forecasts of the 6-month Treasury bill yield, based off futures data and market yields. Fed Funds Rate · Secured Overnight Financing Rate SOFR. LIBOR London Interbank Offered Rates. 1 Month LIBOR Rate · 3 Month LIBOR Rate · 6 Month LIBOR Rate · 1. Mortgage rates this week · The year fixed-rate mortgage averaged % APR, unchanged from the previous week's average, according to rates provided to. mortgage rates in order to lower their monthly payments. Current Mortgage Rates Data Since xlsx. Opinions, estimates, forecasts, and other views. Fixed Income Analysis (ESR Interest Rate Forecast) of US Interest Rates Single Maturity Forecast. Maturity. 6 Month. 0% 2% 4% 6% 8% Mortgage rate predictions for ; Wells Fargo, % ; Mortgage Bankers Association, % ; Fannie Mae, % ; National Association of Home Builders, %. The latest global economic outlook for from the World Bank. Learn about economic trends, policies, GDP growth, risks, and inflation rates. Forward Curve is the market's projection of LIBOR based on Eurodollar Futures and Swap data. The forward curve is used to price Interest Rate Options. The monthly Economic Outlook includes the Economic Developments Commentary, Economic Forecast, and Housing Forecast – which detail interest rate movement. 5-year daily-updated forecasts of the 6-month Treasury bill yield, based off futures data and market yields. Fed Funds Rate · Secured Overnight Financing Rate SOFR. LIBOR London Interbank Offered Rates. 1 Month LIBOR Rate · 3 Month LIBOR Rate · 6 Month LIBOR Rate · 1. Mortgage rates this week · The year fixed-rate mortgage averaged % APR, unchanged from the previous week's average, according to rates provided to.

party paying 6-month LIBOR (floating rate) to the issuer. Using the above expectations on interest rate levels, yield curve analysis, and change ity groups. 3-month, , , , 6-month, , , , 1-year, , , , Treasury constant maturities. Nominal 9. 1-month, , Interest Rate Forecast. August 23 Canada Economic Forecast T-Bill. 6-mo. T-Bill. Monthly Economic Outlook. Economists Charlie Dougherty and Tim Quinlan Softer growth, cooler inflation and rate cuts remain on the horizon – 05/ Short-term interest rates forecast refers to projected values of three-month money market rates. It is measured as a percentage. Interest rate · Annual percentage rate (APR) · Monthly mortgage payment · Loan origination fees · Rate lock fees · Closing costs. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest. mortgage, interest rate, interest, rate, and USA Finance Rate on Consumer Installment Loans at Commercial Banks, New Autos 48 Month Loan. We currently have a lower annual inflation rate of between and percent. Accordingly, our forecasts still anticipate falling interest rates at the short. If that happens, mortgage rates could still fall to closer to 6% by the end of Rates held steady for the first three months of , remaining confined to. values, consensus figures, forecasts, historical time series and news. Interest Rate Forecast / - was last updated on Friday, September 6, 6 month CD Account. Amerant Bank. Member FDIC. APY. %. September 3, The Fed funds rate is the interest rate that commercial banks charge one. A monthly survey of US consumer attitudes, spending plans, and expectations for inflation, stock prices, and interest rates. Expectations Six Months Hence. Interest Rate Forecast Methods · + basis points on Day 1 · basis points over the first 6 months · Yield curve rotation (short point decreasing, long point. The Federal Reserve maintained the federal funds rate at a year high of %% for the 8th consecutive meeting in July , in line with expectations. Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA 6 Month. , , %, , -. Lithuania Greece Ireland Denmark 0 2 4 6 8 10 End of Short-term interest rates are based on three-month money market rates where available. Interest rate · Annual percentage rate (APR) · Monthly mortgage payment · Loan origination fees · Rate lock fees · Closing costs. Economic growth in Australia is expected to remain subdued in the near term as inflation and higher interest rates continue to weigh on demand. The forecast for.

How Do I Open Up An Ira

At Principal, you can do this with a Principal® SimpleInvest IRA, or by calling us at We do not currently support opening a Principal® IRA with a. Start planning for your future when you open an IRA. Learn how opening an IRA account can help you save for retirement with potential tax advantages. Getting started. IRAs allow you to make tax-deferred investments to provide financial security when you retire. Assess your financial needs. An IRA can be a smart way to invest in your retirement. Learn about the different types of IRAs and how to open an account. An individual retirement account . IRA Savings Account. Available as either a Traditional or a Roth IRA, our IRA Savings helps you save for retirement by making regular contributions that match. There's no minimum amount required by the IRS to open a Roth IRA. But individual providers often set their own account minimums, which can range from as little. Discover how to grow your earnings tax-deferred for retirement with a traditional IRA. Open a traditional IRA from the top IRA provider, Fidelity. Minimum opening deposit. $0. Account fee. $0. Get started. Open a Wells Trade IRA. Intuitive Investor® IRA View details. A simple, easy way to. Open an IRA from Merrill Edge and choose from a wide variety of stocks, bonds, ETFs and well-known mutual funds. At Principal, you can do this with a Principal® SimpleInvest IRA, or by calling us at We do not currently support opening a Principal® IRA with a. Start planning for your future when you open an IRA. Learn how opening an IRA account can help you save for retirement with potential tax advantages. Getting started. IRAs allow you to make tax-deferred investments to provide financial security when you retire. Assess your financial needs. An IRA can be a smart way to invest in your retirement. Learn about the different types of IRAs and how to open an account. An individual retirement account . IRA Savings Account. Available as either a Traditional or a Roth IRA, our IRA Savings helps you save for retirement by making regular contributions that match. There's no minimum amount required by the IRS to open a Roth IRA. But individual providers often set their own account minimums, which can range from as little. Discover how to grow your earnings tax-deferred for retirement with a traditional IRA. Open a traditional IRA from the top IRA provider, Fidelity. Minimum opening deposit. $0. Account fee. $0. Get started. Open a Wells Trade IRA. Intuitive Investor® IRA View details. A simple, easy way to. Open an IRA from Merrill Edge and choose from a wide variety of stocks, bonds, ETFs and well-known mutual funds.

How to Open a Roth IRA in Five Simple Steps · 1. Make sure you're eligible to open a Roth IRA. The first step in opening a Roth IRA is determining if you're. With a traditional IRA, generally you make contributions to save for retirement and pay taxes on withdrawals later. Step-By-Step Guide to Setting Up Your Self-Directed IRA · Step 1: Create an Account With a Self-Directed IRA Custodian · Step 2: Transfer Funds Into the Self-. Start saving for retirement today with an E*TRADE Traditional IRA. A Traditional IRA gives you tax-free contributions and flexible contribution limits. You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others. You can open an IRA through almost any large financial institution, including banks, mutual fund companies and brokerage firms. Why use an IRA to save for retirement? ; Tax advantages. Enjoy tax benefits made to help you put away more. ; FDIC insurance. Deposits are insured by the FDIC up. Minimum opening deposit amount of $ *Regions Investment Solutions is a marketing name of Cetera Investment Services. Securities and insurance. There is no specific right age for opening an IRA, as it depends on individual financial goals and circumstances. People of any age can open an IRA. The first step in opening an IRA is to select the option that fits your individual investment style. It's important to know that application instructions vary. Creating login credentials and providing contact information for your account; Verifying your identity; Indicating how you'll fund the account. How do I fund my. How Can I Start a Roth IRA or a Traditional IRA? You can open your IRA at most banks, credit unions, online brokers, or other financial services providers. Online investing, investment management, retirement planning, IRAs & (k) rollovers, financial goals, explore all services. Start planning for your future when you open an IRA. Learn how opening an IRA account can help you save for retirement with potential tax advantages. No account fees or minimums to open Fidelity retail IRA accounts. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs), and. Open a traditional IRA with Alliant Credit Union and get tax deductible contributions and tax deferred earnings. Our IRA rates are among the best in the. How much can I contribute to an IRA? The annual contribution limit for is $6,, or $7, if you're age 50 or older (, , , and is. How do I open an IRA? · Choose an IRA type. Start simple, with your age and income. · Transfer money. Move money directly from your bank to your new Vanguard IRA. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today.

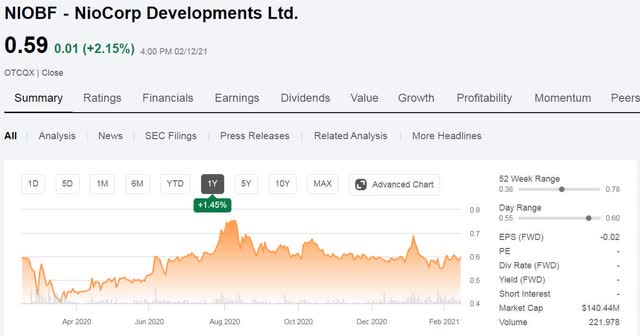

Niobf Stock

Track NioCorp Developments Ltd (NIOBF) Stock Price, Quote, latest community messages, chart, news and other stock related information. H.C. Wainwright Reaffirms Their Buy Rating on NioCorp Developments (NIOBF) Stock quotes by imprimermonlivre.ru · Contact Us · Masthead · Your Privacy Choices. NioCorp Developments' stock was trading at $ on January 1st, Since then, NIOBF shares have decreased by % and is now trading at $ View the. Financial Modeling Prep API provides real time stock price, company financial statements, major index prices, stock historical data, forex real time rate and. Delisted USA. Stock. Niocorp Developments · Summary · Profile · NIOBFDelisted Stock, USD %. As of 7th of August , the value of RSI of. NioCorp Developments Ltd advanced stock chart & Stock technical analysis. View NIOBF Interactive Graph, technical analysis, real-time price quote. NioCorp is a publicly company that is listed on both the Toronto Stock Exchange under the ticker symbol "NB" and on the U.S.-based OTCQX exchange under the. Stay updated on NIOBF (NIOBF) with the latest stock news, press releases, earnings reports and financial insights. Get in-depth analysis and real-time. Discover real-time NIOBF (NIOBF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Track NioCorp Developments Ltd (NIOBF) Stock Price, Quote, latest community messages, chart, news and other stock related information. H.C. Wainwright Reaffirms Their Buy Rating on NioCorp Developments (NIOBF) Stock quotes by imprimermonlivre.ru · Contact Us · Masthead · Your Privacy Choices. NioCorp Developments' stock was trading at $ on January 1st, Since then, NIOBF shares have decreased by % and is now trading at $ View the. Financial Modeling Prep API provides real time stock price, company financial statements, major index prices, stock historical data, forex real time rate and. Delisted USA. Stock. Niocorp Developments · Summary · Profile · NIOBFDelisted Stock, USD %. As of 7th of August , the value of RSI of. NioCorp Developments Ltd advanced stock chart & Stock technical analysis. View NIOBF Interactive Graph, technical analysis, real-time price quote. NioCorp is a publicly company that is listed on both the Toronto Stock Exchange under the ticker symbol "NB" and on the U.S.-based OTCQX exchange under the. Stay updated on NIOBF (NIOBF) with the latest stock news, press releases, earnings reports and financial insights. Get in-depth analysis and real-time. Discover real-time NIOBF (NIOBF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions.

View NioCorp Developments (OTCMKTS:NIOBF) historical prices, past price performance, and an advanced NIOBF stock chart at MarketBeat. NioCorp Developments Ltd. Stock Other OTC · Equities · NIOBF · CA · Specialty Mining & Metals · Financials · Chart NioCorp Developments Ltd. · Latest. (TO:NB) or (OTC:NIOBF)) FAQ. What Is the NioCorp Developments (NB) Stock Price Today? The NioCorp Developments stock price today is What Stock Exchange. Strategies · Stock Market · Equities · NB Stock · NIOBF Stock · News NioCorp Developments Ltd. Insiders. Best financial portal. Best financial portal. +% of. The average price target for NioCorp Developments Ltd is $ This is based on 1 Wall Streets Analysts month price targets, issued in the past 3 months. NIOBF Forecast, Long-Term Price Predictions for Next Months and Year: , NIOBF prediction details. NIOBF (NIOBF) stock price forecast, prediction. Dividend capture strategy is based on NIOBF's historical data. Past performance is no guarantee of future results. Step 1: Buy NIOBF shares 1 day before the ex-. Vanguard Total Stock Market Index Fund ETF Shares. IWC. %. iShares Micro-Cap ETF. NB Company Profile. NioCorp Developments Ltd. logo. NioCorp. NIOBF) today announced that its board of directors has resolved to effect a share consolidation (reverse stock split) (the " Consolidation ") of its issued. Discover real-time NIOBF (NIOBF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Institutional Ownership and Shareholders. NioCorp Developments Ltd (US:NIOBF) has 4 institutional owners and shareholders that have filed 13D/G or 13F forms. NioCorp Developments Ltd · Breaking News · Stock Market Today: Stocks rebound with Apple, CPI inflation in focus · Veteran investor sets his sights on Palantir. Real-Time News, Market Data and Stock Quote for NIOCORP DEVELOPMENTS. About (imprimermonlivre.ru) · Markets Performance · Site Index · Latest · Media · Browse · About Reuters · Stay Informed. NioCorp's stock trades on the Nasdaq under the ticker symbol “NB“. READ MORE · · 2nd Largest Indicated Rare Earth Resource. The Elk Creek Mineral Resource is. View NioCorp Developments Ltd (NIOBF) company profile, FAQs, interesting facts What was NioCorp Developments Ltd stock price yesterday? NioCorp. Get NioCorp Developments Equity Warrants Exp 17th Mar (NIOBW:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Find the historical stock prices of NIOCORP DEVELOPMENTS (NIOBF). NIOBF - Short squeeze stock short interest data and short selling information for shares of NIOCORP DEVELOPMENTS. Short interest stock data available for.

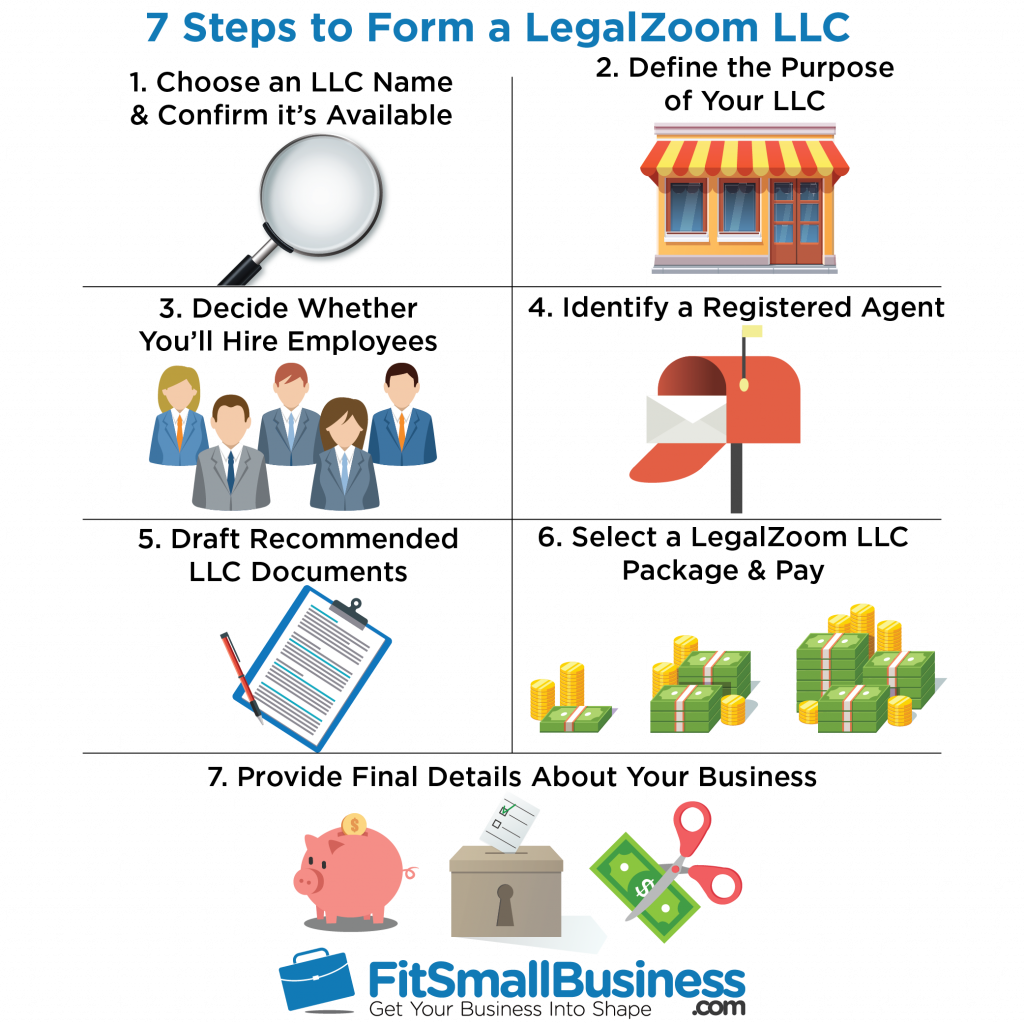

Why Should I Create An Llc

Advantages of Forming an LLC · Easy setup. LLCs with one member only need to fill out a one-page form. · Inexpensive. Setup should only cost a couple hundred. 1. Why should I form an LLC? An LLC isn't required, but forming an LLC can help protect your personal assets. Through an LLC, you can open a business bank. You should start an LLC to limit personal liability, enjoy flexibility in management and taxation, and gain credibility and protection for your business. If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form , U.S. Corporation Income Tax Return. The is. 5 Things You Should Know About Forming an LLC · An LLC gives you the best of two worlds. · LLCs offer flexibility for owners. · The owners of an LLC are. Q: Does Ohio law permit the formation of a series LLC? A limited liability company may create separate series of assets and liabilities organized under a. An LLC is the simplest and most flexible business structure for a home-based business to form and maintain. It provides the benefits of both a. What does LLC mean? This business legal entity is a hybrid between a corporation and a partnership. LLCs have some tax benefits as well as ownership advantages. Which is better: LLC or S Corp? According to our calculations, the benefits for S Corp owners start at around $80, per year. If you make less than $80, Advantages of Forming an LLC · Easy setup. LLCs with one member only need to fill out a one-page form. · Inexpensive. Setup should only cost a couple hundred. 1. Why should I form an LLC? An LLC isn't required, but forming an LLC can help protect your personal assets. Through an LLC, you can open a business bank. You should start an LLC to limit personal liability, enjoy flexibility in management and taxation, and gain credibility and protection for your business. If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form , U.S. Corporation Income Tax Return. The is. 5 Things You Should Know About Forming an LLC · An LLC gives you the best of two worlds. · LLCs offer flexibility for owners. · The owners of an LLC are. Q: Does Ohio law permit the formation of a series LLC? A limited liability company may create separate series of assets and liabilities organized under a. An LLC is the simplest and most flexible business structure for a home-based business to form and maintain. It provides the benefits of both a. What does LLC mean? This business legal entity is a hybrid between a corporation and a partnership. LLCs have some tax benefits as well as ownership advantages. Which is better: LLC or S Corp? According to our calculations, the benefits for S Corp owners start at around $80, per year. If you make less than $80,

A limited liability company (LLC) is a way to legally structure a business. It combines the limited liability of a corporation with the flexibility and lack. If you envision a smaller operation or one that will primarily involve a few key owners, an LLC might be a good fit because of its flexibility and simplicity. A limited liability company (LLC) is a business structure that offers limited personal liability on the part of the owner. An LLC may also offer the possibility. An LLC is a limited liability company; it protects a business owner's personal assets. Learn the pros and cons of LLCs and how to start one. Benefits of forming a Limited Liability Company (LLC) · Separate legal identity · Limited liability · Perpetual existence · Flexible management structure · Free. While an LLC business structure isn't required, business partners and solopreneurs may form a limited liability company to protect personal finances and assets. Who Should Form an LLC? If you like the ease of running a sole proprietorship or a partnership but need liability protection, then you may want to consider. This article discusses the choice of entity issues that should be examined when considering the LLC form, and particularly LLCs organized under New Jersey law. An LLC may elect to be taxed as Corporation or an C Corporation. While it is an uncommon choice, filing an LLC as a C Corp tax designation does make financial. The decision regarding business structure is a decision that a person should make Nevertheless, persons contemplating forming an LLC are well advised to. Creating a limited liability company (LLC) is a much simpler process than creating a corporation and generally takes less paperwork. LLCs are under the. Effective date of election. An LLC that does not want to accept its default federal tax classification, or that wishes to change its classification, uses Form. An LLC, or limited liability company, provides personal liability protection and a formal business structure. You can also get those things by forming a. 1. Why should I form an LLC? An LLC isn't required, but forming an LLC can help protect your personal assets. Through an LLC, you can open a business bank. Simple and generally inexpensive to form, LLCs offer a layer of asset protection for the owner, helping independent contractors avoid the consequences of. The most common advantage you will hear from people who recommend forming an LLC is that you can avoid the “double tax” associated with a C corporation. An LLC is an unincorporated business organization of one or more persons who have limited liability for the contractual obligations and other liabilities of the. Having both an LLC and DBA offers the benefits of an LLC's liability protection while also giving the flexibility to use different business names. However. An operating agreement for LLCs sets out the rights, powers, duties, liabilities and obligations of each member to the LLC. This document does not need to be. Advantages of Forming an LLC · Easy setup. LLCs with one member only need to fill out a one-page form. · Inexpensive. Setup should only cost a couple hundred.

Fungible Token Definition

NFT stands for 'non-fungible token'. Non-fungible means that something is unique and can't be replaced. By contrast, physical money and cryptocurrencies are. A non-fungible token (NFT) is a way of proving that a digital item is the only one of its kind in existence. Therefore it cannot be copied or reproduced without. Non-fungible tokens (NFTs) are assets like a piece of art, digital content, or video that have been tokenized via a blockchain. Definition of 'non-fungible token'. non-fungible token in British English. noun. the full form of NFT (sense 2). Collins English Dictionary. Copyright. NFTs (non-fungible tokens) are unique cryptographic tokens that exist on a blockchain and cannot be replicated. NFTs can represent digital or real-world items. An NFT, or non-fungible token, is a unique unit of data stored on a blockchain infrastructure that cannot be copied or replicated, providing a secure record of. a unique digital identifier that cannot be copied, substituted, or subdivided, that is recorded in a blockchain, and that is used to certify authenticity. In order to define NFTs, it is worth explaining the concept of fungibility and non-fungibility. An asset is considered to be fungible when there is the. The definition of a Non-Fungible Token, also known as an NFT, is a digital certificate (or token) which is stored on decentralized ledgers popularly referred to. NFT stands for 'non-fungible token'. Non-fungible means that something is unique and can't be replaced. By contrast, physical money and cryptocurrencies are. A non-fungible token (NFT) is a way of proving that a digital item is the only one of its kind in existence. Therefore it cannot be copied or reproduced without. Non-fungible tokens (NFTs) are assets like a piece of art, digital content, or video that have been tokenized via a blockchain. Definition of 'non-fungible token'. non-fungible token in British English. noun. the full form of NFT (sense 2). Collins English Dictionary. Copyright. NFTs (non-fungible tokens) are unique cryptographic tokens that exist on a blockchain and cannot be replicated. NFTs can represent digital or real-world items. An NFT, or non-fungible token, is a unique unit of data stored on a blockchain infrastructure that cannot be copied or replicated, providing a secure record of. a unique digital identifier that cannot be copied, substituted, or subdivided, that is recorded in a blockchain, and that is used to certify authenticity. In order to define NFTs, it is worth explaining the concept of fungibility and non-fungibility. An asset is considered to be fungible when there is the. The definition of a Non-Fungible Token, also known as an NFT, is a digital certificate (or token) which is stored on decentralized ledgers popularly referred to.

NON-FUNGIBLE TOKEN meaning: 1. a unique unit of data (= the only one existing of its type) that links to a particular piece of. Learn more. Fungibility roughly translates to the ability to be replaced by something identical — when something is fungible, there are typically many of them that are the. Fungible tokens (FTs) are a type of digital asset built on blockchain technology, designed to be identical and interchangeable with one another. They are. Fungible tokens or assets are divisible and non-unique. For instance, fiat currencies like the dollar are fungible: A $1 bill in New York City has the same. A non-fungible token (NFT) is a unique digital identifier that is recorded on a blockchain and is used to certify ownership and authenticity. A representation of an asset on a blockchain that is interchangeable. Cryptocurrencies are the prime example of fungible tokens because each coin has the. In broader use, fungible can mean “interchangeable,” or sometimes “readily changeable to adapt to new situations.” Synonyms. Adjective. commutable. An NFT, or Non-Fungible Token, is a unique digital asset that represents ownership or proof of authenticity of a unique item or piece of content, primarily. What is fungibility? If something is fungible, it's easily exchanged with something of equal value. It's the ability of a good or an item to be interchanged. What does the noun non-fungible token mean? There is one meaning in OED's See 'Meaning & use' for definition, usage, and quotation evidence. See. Non-fungible tokens, often referred to as NFTs, are blockchain-based tokens that each represent a unique asset like a piece of art, digital content, or media. Fungibility is the ability of a good or asset to be interchanged with other individual goods or assets of the same type. Fungible assets simplify the. Non-fungible tokens (NFTs) are a kind of cryptoasset in which each token is unique What are NFTs? Definition. NFTs (or “non-fungible tokens”) are a special. Non-fungible tokens are units of data stored on a blockchain that uniquely represent digital assets in a metaverse, such as in-game items, collectibles. Non-Fungible Token (NFT) meaning: Non-Fungible Token (NFT) - a unique digital asset stored on a blockchain that represents real objects and that cannot be. Non-fungible tokens (NFTs) What are NFTs? (NFTs). An NFT is a cryptographic record of ownership for a unique item that is encoded into a blockchain. It. Fungible refers to the interchangeability of an identical coin or token. Related Words. Liquidation Call. A liquidation call is the process where a. Non-fungible tokens (NFTs) are units of data that are tokenized and stored on a blockchain. Non-fungible tokens (NFTs) are cryptocurrencies that do not possess the property of fungibility. Fungibility refers to one asset being equal to another asset or interchangeable with another asset. Money or cryptocurrencies can be exchanged for each other.

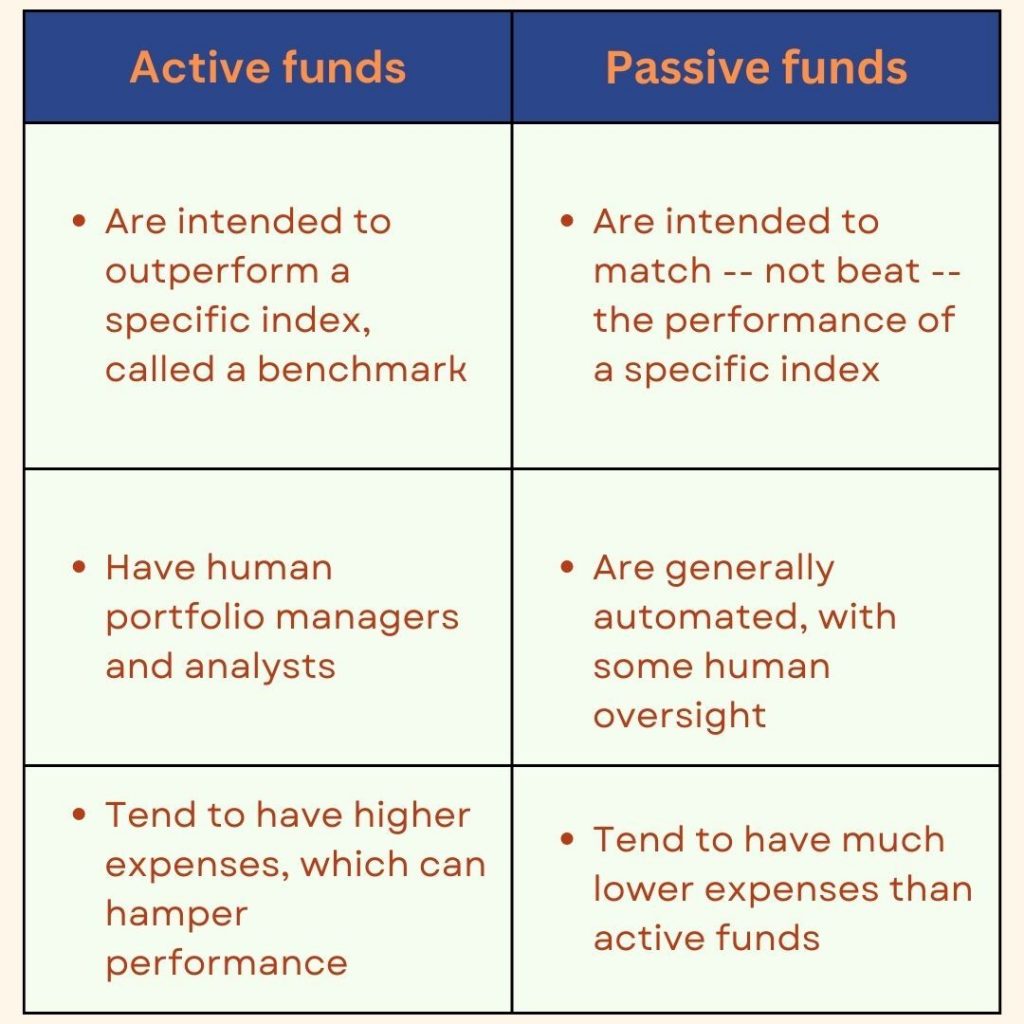

Passive Vs Active Funds

Fast forward years to , and the first mutual fund (actively managed unit trust) was established in the US (the Massachusetts. Investors Trust), which. Typically, passive funds own many of the same securities, and in the same weightings, as their respective indexes. Passive fund managers make no “active. What is passive investing? Passive investing means investing in funds that aim to match the returns of a specific market or index. They don't try to beat it. With actively managed funds, there are typically more investment trades being facilitated than a passively managed buy-hold fund. These trades create short and. Long-term growth. Historically, passive funds have generated returns over extended time periods. · Affordability. Passive investing is relatively cheaper because. Like passive investments, there are many types of actively managed funds which offer exposure to different asset classes and industries. Rather than track an. Active investments are funds run by investment managers who try to outperform an index over time, such as the S&P or the Russell Passive investments. What are passive funds? A passive, or index-tracking, fund is managed with the aim of replicating the performance of a specific index. To track the FTSE Active management has typically outperformed passive management during market corrections, because active managers have captured more upside as the market. Fast forward years to , and the first mutual fund (actively managed unit trust) was established in the US (the Massachusetts. Investors Trust), which. Typically, passive funds own many of the same securities, and in the same weightings, as their respective indexes. Passive fund managers make no “active. What is passive investing? Passive investing means investing in funds that aim to match the returns of a specific market or index. They don't try to beat it. With actively managed funds, there are typically more investment trades being facilitated than a passively managed buy-hold fund. These trades create short and. Long-term growth. Historically, passive funds have generated returns over extended time periods. · Affordability. Passive investing is relatively cheaper because. Like passive investments, there are many types of actively managed funds which offer exposure to different asset classes and industries. Rather than track an. Active investments are funds run by investment managers who try to outperform an index over time, such as the S&P or the Russell Passive investments. What are passive funds? A passive, or index-tracking, fund is managed with the aim of replicating the performance of a specific index. To track the FTSE Active management has typically outperformed passive management during market corrections, because active managers have captured more upside as the market.

An actively managed fund means a fund manager has more involvement in the decision making, is more active in looking after which stocks and bonds go in and out. Because passive funds have outperformed active funds on average in rising markets, the strategy of utilizing active funds is similar to “fighting the tide”. Passive Mutual Funds: pools money from investors to purchase stocks, bonds, and other assets. Minimum initial investments for mutual funds are normally a flat. What is Active and Passive Investing? Active fund managers attempt to beat the market (or their particular benchmark) by picking and choosing among. Passive investing is often less expensive than active investing because fund managers are not picking stocks or bonds. Passive funds allow a particular index to. We don't think the active versus passive debate has a simple answer, but is dependent on the amount of opportunity that active managers have at any point in. A passive fund is a type of fund that religiously tracks a market index to allow a fund to fetch maximum gains. The fund manager does not actively choose what. Nature: Active funds are more dynamic and flexible, as they can adapt to changing market conditions and opportunities. Passive funds are more static and rigid. Typically, passive funds own most of the same securities, and in the same weightings, as their respective indices. Passive fund managers make no active. Passive investments, on the other hand, invests to match a specific index, for instance the S&P/NZX 20, rather than picking shares based on the fund manager's. With passive investing, there is no fund manager paid to choose individual funds charge ultra-low fees that are below those of active funds. Index. Active funds may be relatively riskier depending on the type of Fund. For instance, an active equity fund can carry a higher risk than an active debt fund. Active funds try to beat market returns with investments hand-picked by professional money managers. Compare indexing & active management. Each strategy has a. Active funds typically have expense ratios of –%. Passive funds have ratios closer to –%, as their operating and administrative costs are lower. Passive investing, meanwhile, seeks to track or mirror a market index rather than beat it. Many investors want to know if it's better to purchase an actively. In short, passive fund management delivers a return in line with how the tracked index performs. A key reason why this type of fund appeals to investors is. Flexibility: Active managers aren't tied to a specific index and can pick and choose any actively managed fund investment from the stock market that provides. Active investing is exactly the opposite approach. Fund managers are much more involved. They do a lot more buying and selling within the fund to try and beat. Traditionally, actively managed funds have been the preferred options amongst investors, with passive funds largely overlooked. The trend is rapidly changing. In an “active” mutual fund, investors pool their money and give it to a manager who picks investments based on his or her research, intuition and experience. In.

List Of Things Self Employed Tax Deductions

When you itemize your business expenses, you can take tax write offs for things like medical expenses, property taxes and charitable donations. Is FICA self-. 10 Tax Deductible Expenses for the Self-Employed in Ireland · 1. Consultancy & Professional Fees · 2. Advertising Costs · 3. Rent, Rates & Power · 4. Wages. Home office expenses · Self-employment tax deduction · Health insurance · Travel · Meals and entertainment · Phone and internet costs · Retirement contributions. If your business pays employment taxes, the employer's share is deductible as a business expense. Self-employment tax is paid by individuals, not their. Some deductions are exclusive to individuals who qualify as self-employed. These deductions, including business costs like advertising, bank fees, interest. As a new business, you can generally deduct up to $5,* of start-up expenses (e.g., salaries, marketing, market analysis, etc.) and $5,* of organizational. Home office expenses · Self-employment tax deduction · Health insurance · Travel · Meals and entertainment · Phone and internet costs · Retirement contributions. Certain deductions may be taken when computing the business tax. These deductions include, but are not limited to, cash discounts, trade-in amounts, amounts. Seven Overlooked Tax Deductions for the Self-Employed · Tax deduction for business use of a vehicle · Sponsored Content Dianomi · Tax write-off for Social. When you itemize your business expenses, you can take tax write offs for things like medical expenses, property taxes and charitable donations. Is FICA self-. 10 Tax Deductible Expenses for the Self-Employed in Ireland · 1. Consultancy & Professional Fees · 2. Advertising Costs · 3. Rent, Rates & Power · 4. Wages. Home office expenses · Self-employment tax deduction · Health insurance · Travel · Meals and entertainment · Phone and internet costs · Retirement contributions. If your business pays employment taxes, the employer's share is deductible as a business expense. Self-employment tax is paid by individuals, not their. Some deductions are exclusive to individuals who qualify as self-employed. These deductions, including business costs like advertising, bank fees, interest. As a new business, you can generally deduct up to $5,* of start-up expenses (e.g., salaries, marketing, market analysis, etc.) and $5,* of organizational. Home office expenses · Self-employment tax deduction · Health insurance · Travel · Meals and entertainment · Phone and internet costs · Retirement contributions. Certain deductions may be taken when computing the business tax. These deductions include, but are not limited to, cash discounts, trade-in amounts, amounts. Seven Overlooked Tax Deductions for the Self-Employed · Tax deduction for business use of a vehicle · Sponsored Content Dianomi · Tax write-off for Social.

This invaluable book, updated to reflect changes in tax law, not only lists the individual items that are deductible—from Internet domain name costs to theft. Also, you can deduct one-half of your self-employment tax above-the-line. On top of that, you can deduct business expenses like internet costs, office supplies. Sole trader tax deductions: What can business owners claim? Getting tax deductions as a sole trader is one of the benefits of being self-employed. A tax. When you itemize your business expenses, you can take tax write offs for things like medical expenses, property taxes and charitable donations. Is FICA self-. A Guide to Tax Deductions for the Self-Employed · Qualified business income. · Mileage or vehicle expenses. · Retirement savings. · Insurance premiums. · Office. See Income Tax Information Bulletin # for more information. Indiana deductions are used to reduce the amount of taxable income. First, check the list below. You can deduct accounting or legal fees you paid to have an objection or appeal prepared against an assessment for income tax, Canada Pension Plan (CPP) or. From October 1, through June 30, restaurants could take a sales tax exemption for purchases of the following items: Items used to flavor food that are. These benefits are excluded from wages, so they are deductible for you as an independent contractor. The dependent care benefits are tax-free for the employee. #7. Self-Employment Tax Deduction. If you run your own business, like a sole proprietorship, partnership, or LLC, you pay a tax called. 1. Student loan interest · 2. Self-employment tax deduction · 3. Spousal support, alimony, or maintenance · 4. Teachers' tax-deductible expenses · 5. Self-employed. Eligibility (for business insurance): You can deduct premiums as long as they're directly related to your freelance work. Similar to other deductions for. Self-employment health insurance. Interest Expenses. Interest or penalties paid on loans that are used for business purposes are usually tax-deductible. Car or truck expenses – The costs of operating and maintaining your own vehicle when traveling on business are also deductible. As is the case with day-to-day. Enter the home office deduction: It's a powerful tax break exclusively for the self-employed. And it lets you write off a chunk of your living expenses. Who. You'll list out these expenses on Part V, Other expenses (Line 48). This can include Uber and Lyft fees and commissions, Lyft's Express Drive Rental fees. A Guide to Tax Deductions for the Self-Employed · Qualified business income. · Mileage or vehicle expenses. · Retirement savings. · Insurance premiums. · Office. Moving expenses. No provision. One-half of self employment taxes. No provision. Self-employed health insurance deduction. No provision. Self-employed SEP. employment, provided these expenses were not deducted from federal adjusted gross income. Long-Term Health Care Premiums. Enter the amount of premiums paid.

The Best Online Tax Filing Service

H&R Block is our pick for the best overall tax preparation service due to its large network of branches that offer several tax preparation and filing options. Our product & pricing comparison chart makes it easy to choose the best online tax filing option to simplify your taxes for your family or your business. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. H&R Block's Premium and Business tax software makes it easy to prepare and file your small business's federal and state tax returns. You'll also be able to. Some low income and military taxpayers may qualify for free tax preparation and e-filing through the IRS Free File Alliance web page; Most taxpayers can. Only TaxAct provides a DIY online tax filing software for small businesses. We'll help you maximize your credits and deductions while backing our calculations. File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you deserve. TurboTax has the interface most liked by users and reviewers, making tax filing speedier and easier. This could become even more efficient with the addition of. File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you. H&R Block is our pick for the best overall tax preparation service due to its large network of branches that offer several tax preparation and filing options. Our product & pricing comparison chart makes it easy to choose the best online tax filing option to simplify your taxes for your family or your business. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. H&R Block's Premium and Business tax software makes it easy to prepare and file your small business's federal and state tax returns. You'll also be able to. Some low income and military taxpayers may qualify for free tax preparation and e-filing through the IRS Free File Alliance web page; Most taxpayers can. Only TaxAct provides a DIY online tax filing software for small businesses. We'll help you maximize your credits and deductions while backing our calculations. File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you deserve. TurboTax has the interface most liked by users and reviewers, making tax filing speedier and easier. This could become even more efficient with the addition of. File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you.

Prepare your taxes online with Jackson Hewitt's easy to use tax filing software. Backed by industry leading guarantees. Discover tax filing software that makes DIY preparation easy. H&R Block offers a range of tax preparation software for everyone from basic filers to. Get more with Jackson Hewitt tax preparation services. We're open late and weekends. Our Tax Pros service in nearly locations, with in Walmart. For over 10 years, UltimateTax has been a leader in professional tax software. Not all tax software is made equally. With UltimateTax, you can expect a stable. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. The Free File Alliance is a nonprofit coalition of industry-leading tax software companies partnered with Montana to help our taxpayers prepare and e-file. Free Online Filing Providers · com · Now · FreeTaxUSA · Online Taxes Inc. · TaxSlayer. MilTax is a suite of free tax services for the military from the Defense Department, including easy-to-use tax preparation and e-filing software. For over 10 years, UltimateTax has been a leader in professional tax software. Not all tax software is made equally. With UltimateTax, you can expect a stable. free electronic tax services to qualifying taxpayers. Product Name, Eligibility Requirements (Tax Year ). Adjusted Gross Income: Between $17, and. I like FreetaxUSA. They have an option called Pro Support for an extra $, where you can talk to a tax professional. That's a lot cheaper. H&R Block offers DIY preparation and filing, but if you get partway through and realize you're not sure of some tax issues, you can have an H&R Block tax. For comparison purposes, here is a list of the eight most popular online tax filing softwares ordered by price. All of CNBC Select's best tax software programs allow eligible users to file a simple tax return for free. The one exception is TaxAct, which charges a fee per. Free tax preparation services are available for low- to moderate-income Browsers: Free File Fillable Forms will work best when using the latest version of. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. · FreeTaxUSA is a great company that makes tax filing easy and. Michigan Department of Treasury does not endorse the companies, nor do we guarantee their products, services, or prices. We recommend review of the product. MyFreeTaxes is an easy online tool that helps you file your taxes for free. The site offers free step-by-step guidance to filing taxes as well as help through. This list of the best tax software of for accounting professionals was compiled from multiple sources, including ZDNet and PC Mag. TaxSlayer Pro Classic includes everything you need to prepare, file, and transmit your clients' tax returns. "I wouldn't even try to do a tax season without.

1 2 3 4 5 6