imprimermonlivre.ru Tools

Tools

Daily Technical Analysis

technical analysis. Tools of the Trade. The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy. Comprehensive technical analysis and market news for forex, indices and commodities markets. Get technical and fundamental analysis daily. Real time technical analysis overview for the major currency pairs. This analysis is a comprehensive summary derived from simple and exponential moving averages. Currency Market Technical Analysis - Forex Analytics. See technical analysis. Select all, 1 day Analysis; Trading Ideas. Market Overview; Technical Summary. Daily reports typically have a technical overview on SPX , covering near-term trend, momentum, and areas of support/resistance. This is followed by other. Receive daily insights and analysis for successful trading with Daily Technical Analysis. Our platform provides comprehensive technical analysis of various. Technical Analysis is the study of how prices in freely traded markets behaved through the recording, usually in graphic form, of price movements in financial. Watch undefined from Investor's Business Daily Video. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and. technical analysis. Tools of the Trade. The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy. Comprehensive technical analysis and market news for forex, indices and commodities markets. Get technical and fundamental analysis daily. Real time technical analysis overview for the major currency pairs. This analysis is a comprehensive summary derived from simple and exponential moving averages. Currency Market Technical Analysis - Forex Analytics. See technical analysis. Select all, 1 day Analysis; Trading Ideas. Market Overview; Technical Summary. Daily reports typically have a technical overview on SPX , covering near-term trend, momentum, and areas of support/resistance. This is followed by other. Receive daily insights and analysis for successful trading with Daily Technical Analysis. Our platform provides comprehensive technical analysis of various. Technical Analysis is the study of how prices in freely traded markets behaved through the recording, usually in graphic form, of price movements in financial. Watch undefined from Investor's Business Daily Video. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and.

Technical Analysis. Meet other local people interested in Technical Analysis theDistrict Investor's Business Daily® Group. TI. Organized by Investor's. Technical trading analysis on currencies including charts on foreign exchange. Foreign exchange analysis Daily News Wrap · Twitter ForexLive · Telegram. The price of an asset usually moves in predictable trends. This assumption states that despite the millions of individual price movements recorded in a day. Daily Technical Analysis · Dow Jones closes above support 3/9/ · USD/JPY is based on support 3/9/ · GBP presses support 3/9/ · Oil: Double Top. DeltaStock's daily technical analyses are provided by a team of professional dealers with many years of experience in the forex, indices, and shares trading. DeltaStock's daily technical analyses are provided by a team of professional dealers with many years of experience in the forex, indices, and shares trading. Someone who uses technical analysis is called a technical analyst. Traders who daily trading journey. Copyright © imprimermonlivre.ru LLC. All rights. Technical trading analysis on currencies including charts on foreign exchange. Foreign exchange analysis Daily News Wrap · Twitter ForexLive · Telegram. Name, Type, 5 Minutes, 15 Minutes, Hourly, Daily. EUR/USD. Moving Averages: Buy, Strong Buy, Buy, Buy. Indicators: Strong Buy, Strong Buy. Catch Up on the daily US & EU market analysis and reviews valid for to make a better educated. Access daily technical analysis, chart analysis, and market sentiment prepared by a team of professional market analysts. Go to Technical Analysis. Line charts only provide one data point, the closing price of a stock, but candlestick charts provide five: open, close, low of day (LOD), high of day (HOD). Catch Up on the daily US & EU market analysis and reviews valid for to make a better educated. Technical analysis is a trading tool employed to evaluate On Daily timeframe, Broadening wedge pattern breakout occured in JKCEMENT near level. Technical Analysis Indicators For example, many technical traders will place a stop-loss order below the day moving average of a certain company. Currency Market Technical Analysis - Forex Analytics. See technical analysis. Select all, 1 day Technical Analysis; Trading Ideas. Market Overview; Technical. Daily technical analysis report 5/31/ Finance and economics explained simply. Daily technical analysis report 5/31/ SoFi Technologies, Inc. Financials, medium, UPVOTE. , SOXL, Direxion Daily Semiconductors Bull 3x Shares, ETF, medium, UPVOTE. , SPGI. Integrate technical analysis across your brokerage platform to support user trade decisions with timely insights and actionable research. For example, a "20 day Moving Average" is the sum of the prices over 20 days divided by Moving averages show you how the current price compares to an.

Gold Price Notification App

If you'd like to receive a gold price alert, simply enter your email, choose Gold as your metal, and set your target price. Money Metals will send the alert. I have the APMEX app set with Gold alert under $ Silver alert under $10 Hasn't gone off yet, but I'm pretty sure it works. Gold Price Tracker is the easiest way to keep track of current gold prices! Feature include: Select preferred display currency from 31 currencies. The OneGold Mobile app has modernized gold and silver investing. With live spot prices, 24/7 trading, interactive portfolio tools, custom market alerts, and. Gold & Silver Bullion Tracker is a paid app for Android published in the Other list of apps, part of Business. The company that develops Gold & Silver Bullion. If you encounter these questions, this is the best app to help you make correct decisions. This Android application helps you track gold live prices in major. Completely free software to view the price of gold, so you can always use the phone through a simple operation, check with the US dollar-denominated gold NT. Get alert notifications when the price of gold changes or hits your target via Email, SMS, Telegram, Discord and more. Go to 'Settings' on your phone, then tap 'Notifications', then 'App settings' and choose 'Rush Gold' under 'All apps'. If you'd like to receive a gold price alert, simply enter your email, choose Gold as your metal, and set your target price. Money Metals will send the alert. I have the APMEX app set with Gold alert under $ Silver alert under $10 Hasn't gone off yet, but I'm pretty sure it works. Gold Price Tracker is the easiest way to keep track of current gold prices! Feature include: Select preferred display currency from 31 currencies. The OneGold Mobile app has modernized gold and silver investing. With live spot prices, 24/7 trading, interactive portfolio tools, custom market alerts, and. Gold & Silver Bullion Tracker is a paid app for Android published in the Other list of apps, part of Business. The company that develops Gold & Silver Bullion. If you encounter these questions, this is the best app to help you make correct decisions. This Android application helps you track gold live prices in major. Completely free software to view the price of gold, so you can always use the phone through a simple operation, check with the US dollar-denominated gold NT. Get alert notifications when the price of gold changes or hits your target via Email, SMS, Telegram, Discord and more. Go to 'Settings' on your phone, then tap 'Notifications', then 'App settings' and choose 'Rush Gold' under 'All apps'.

This application is a Tool for the Users to get Alert about the Drop or Rise in the Gold Price. So that they can Invest in Gold and get Benefits. BullionByPost is a great best place to view and track the gold price via our fast loading charts. We accurately provide you with all the real-time fluctuations. Important: Price tracking is available in the US and India only. You can track the price of a product when you find the Track price button on Google Search. Receive alert notifications to your desktop and smartphone; Manage alerts via the website or apps using the Alert Center, and review them on the Alerts Feed. Know when the time is right for you to invest by creating customizable email and text alerts for when the gold price or silver price reaches set values. We provide live, interactive gold charts and graphs so you can track, monitor and record the latest changes to prices of gold around the world. This Android application helps you track gold live prices in Dubai. New and enhanced UI. Accurate gold prices. Supports silver and 24/22 Carat gold prices. Keep up to date with all the latest price alerts in gold, silver, and platinum. Open a BullionVault Account today and stay ahead of the pricing news >>. I was looking for a closing price notification which this app does perfectly. I ended up setting several other alerts beside closing price, which especially. Precious and base metals quotes in multiple currencies · Mining news and stocks · Currencies exchange rates (FX) · Cryptocurrency prices and news · Widget (Android. Simply create an account or log in to set up market price alerts. Tell us your Gold, Silver, Platinum or Palladium target price and we will send you an email or. Never miss a buying or selling opportunity! Get automated gold price alerts with our gold spot price API & increase customer conversions & sales. To receive FREE Gold Price Alerts via SMS, enter your 10 digit mobile number. + Continue Note: This facility is currently FREE and available for users in. In a dynamic precious metals market, JM Bullion's free Alerts tools are your key to making knowledgeable investment decisions. Price Alerts. Choose the Right. Gold Price Live - Gold Price Live is a free Android app released by one of the world's most popular gold websites imprimermonlivre.ru established in Download the free GoldBroker app on your smartphone or tablet (iOS & Android). Follow the Gold & Silver Markets News, Anywhere, Anytime. For all the assets that you hold or watch, you can set up price movement alerts and other related notices in the app. You can also set up custom price alerts. Kitco's new and improved, award-winning* Gold Live!, gives you access to the latest market price quotes, charts, precious metals news and expert opinions. Set Gold, Silver, Platinum & Palladium Spot Price Market Alerts. Get a SMS text message or e-mail notification when your set spot price hits! Precious Metal Spot for Android and Windows is what I use the most. It's fast, gives me relevant notifications and has great amount of tools for comparisons.

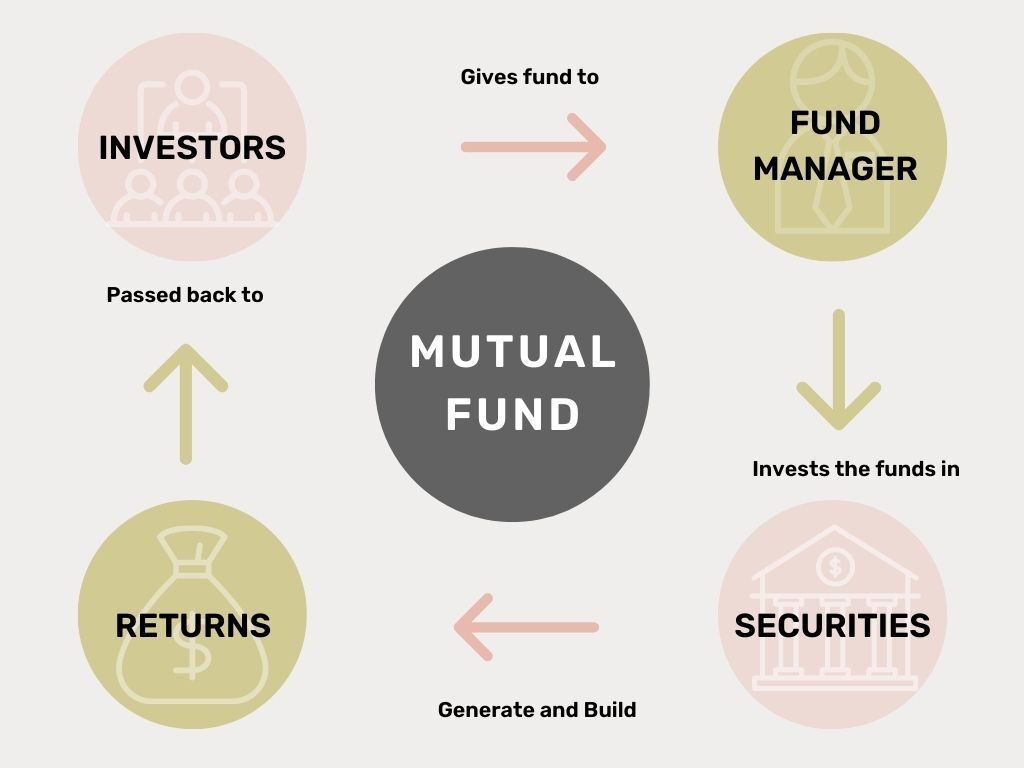

Rochester Mutual Funds

Investment Policy. The Fund seeks as high a level of income exempt from federal income tax and New York State and New York City personal income taxes while. Find the latest performance data chart, historical data and news for Invesco Rochester New York Municipals Fund Class A (RMUNX) at imprimermonlivre.ru The fund seeks higher levels of tax-free income by buying high yield and investment grade municipal bonds that are exempt from federal personal income. Don't let mutual funds siphon away your returns. The SPDR Barclays Capital New York Muni Bond (INY) is an Exchange Traded Fund. It is a "basket" of securities. Get Invesco Rochester New York Municipals Fund (RMUNX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. ORNAX | A complete Invesco Rochester Municipal Opportunities Fund;A mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and. Mutual Fund OneSource® funds have no loads and generally have no transaction fees. Funds appearing on the Mutual Fund OneSource® Select List are chosen based on. Get the latest Invesco Rochester® Municipal Opportunities Fund Class Y (ORNYX) real-time quote, historical performance, charts, and other financial. Invesco Rochester ® New York Municipals A's Average Process Pillar and People Pillar ratings result in a Morningstar Medalist Rating of Neutral. Investment Policy. The Fund seeks as high a level of income exempt from federal income tax and New York State and New York City personal income taxes while. Find the latest performance data chart, historical data and news for Invesco Rochester New York Municipals Fund Class A (RMUNX) at imprimermonlivre.ru The fund seeks higher levels of tax-free income by buying high yield and investment grade municipal bonds that are exempt from federal personal income. Don't let mutual funds siphon away your returns. The SPDR Barclays Capital New York Muni Bond (INY) is an Exchange Traded Fund. It is a "basket" of securities. Get Invesco Rochester New York Municipals Fund (RMUNX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. ORNAX | A complete Invesco Rochester Municipal Opportunities Fund;A mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and. Mutual Fund OneSource® funds have no loads and generally have no transaction fees. Funds appearing on the Mutual Fund OneSource® Select List are chosen based on. Get the latest Invesco Rochester® Municipal Opportunities Fund Class Y (ORNYX) real-time quote, historical performance, charts, and other financial. Invesco Rochester ® New York Municipals A's Average Process Pillar and People Pillar ratings result in a Morningstar Medalist Rating of Neutral.

Mutual funds pool investment dollars from many individual investors to Rochester, NY ; · · Send a Message · Home; About Us. Oppenheimer Rochester Fund Municipals held nearly securities as of December 31, The Fund was invested in a broad range of sectors, providing. Find company research, competitor information, contact details & financial data for MUTUAL FUNDS ASSOCIATES, INC. of Rochester, NY. It is a "basket" of securities that index the Muni Massachusetts investment strategy and is an alternative to a Muni Massachusetts mutual fund. Fees are very. The fund invests in a diverse portfolio of municipal securities with at least 8 percent of the fund's assets invested in New York state-issued munis. Under normal market conditions, and as a fundamental policy, the fund invests at least 80% of its net assets (plus borrowings for investment purposes) in. The Economics of Mutual Fund Markets: Competition Versus Regulation (Rochester Studies in Managerial Economics and Policy, 7): Economics. Vanguard New York Long-Term Tax-Exempt Fund Investor Shares. $ VNYTX %. Invesco Rochester® Municipal Opportunities Fund Class A. Invesco Rochester® Municipal O (0PF12J). Follow. (%). At Top Mutual Funds. UOPSX ProFunds UltraNASDAQ Fund. +%. UOPIX. Invesco Rochester® Limited Term New York Municipal Fund Class C. NAV, Change Trades in no-load mutual funds available through Mutual Funds OneSource. Explore all of the mutual funds and investments offered by each plan. Review important details about performance. Available investments by plan. The investment seeks tax-free income. Under normal market conditions, and as a fundamental policy, the fund expects to invest at least 80% of its net assets. Explore different ways to invest your retirement savings. Hands-off approach Try a one-step solution A target-date fund based on when you'd like to retire. LTNCX Invesco Rochester Limited Term New York Municipal Fund. Are these 3 Top-Ranked Mutual Funds In Your Retirement Portfolio? Zacks • 7. Invesco Rochester Municipal Opportunities Fund Class A. ―. Price Change: ―. Analysis · Holdings · Dividends · Technical Analysis · Performance · Similar Mutual. RMUNX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. At first glance, ETFs have a lot in common with mutual funds. Both offer shares in a pool of investments designed to pursue a specific investment goal. And both. Get Invesco Rochester New York Municipals Fund (RMUNX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. TIAA-CREF Restricted Funds are investment options that are closed to contributions and transfers in as of June 15, , and consist of the following seven. Trending Mutual Funds T. Rowe Price Blue Chip Growth Fund, Inc. $ + +%.

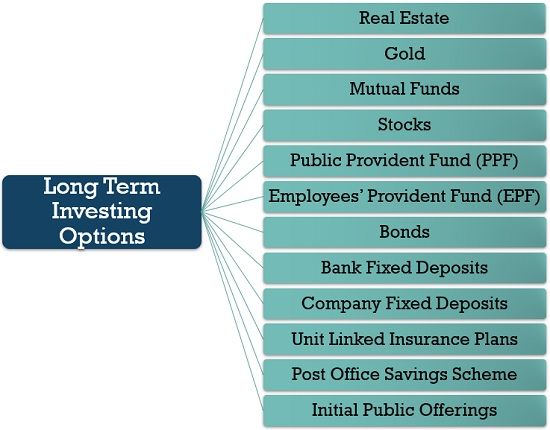

Using Margin For Long Term Investing

Investors use margin for a variety of reasons, from leveraging returns to borrowing against concentrated stock or financing large purchases. Now, higher rates. The use of cross-guarantees to meet any day-trading margin requirements is prohibited. Why Do I Have to Maintain Minimum Equity of $25,? Day trading can be. Margin trading can offer you more buying power, access to ongoing credit, and competitive interest rates. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or. Margin investing increases your buying power (a.k.a. the money you have available to purchase securities) because you're not using solely your own money. Leveraging existing positions with the use of margin magnifies the potential profit as well as loss. Stocks bought on margin are mostly short-term investments. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit. Each broker that offers margin loans has its own terms. In general, though, brokers have a list of investments, usually stocks and bonds, that are considered ". Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. Investors use margin for a variety of reasons, from leveraging returns to borrowing against concentrated stock or financing large purchases. Now, higher rates. The use of cross-guarantees to meet any day-trading margin requirements is prohibited. Why Do I Have to Maintain Minimum Equity of $25,? Day trading can be. Margin trading can offer you more buying power, access to ongoing credit, and competitive interest rates. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or. Margin investing increases your buying power (a.k.a. the money you have available to purchase securities) because you're not using solely your own money. Leveraging existing positions with the use of margin magnifies the potential profit as well as loss. Stocks bought on margin are mostly short-term investments. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit. Each broker that offers margin loans has its own terms. In general, though, brokers have a list of investments, usually stocks and bonds, that are considered ". Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments.

Margin investing can provide flexibility with your cash: if you see an opportunity in the market and want to invest more, you may be able to invest right away. This type of account allows you to borrow from your portfolio so you can get cash to seize other opportunities. We lend you the money you need using the. Leverage Assets. Use the cash or securities in your brokerage account as leverage to increase your buying power. · Access Funds. Get the lowest market margin. Margin trading refers to the practice of using borrowed money from a broker to invest. The term “margin” refers to the amount deposited with a brokerage when. Buying on margin means you are investing with borrowed money. · Buying on margin amplifies both gains and losses. · If your account falls below the maintenance. Short selling on margin allows you to borrow that asset via margin funds, sell it at the current price, then buy it back later at a lower price to make a profit. • Continue to trade and manage investments you use as In addition to offering you immediate access to funds for virtually any short-term borrowing need. No. It is not a good idea to buy an ETF on margin for the long term. Buying a low cost broad market ETF as a savings vehicle over the long term. No, when appropriate, margin proceeds can be used for a variety of funding needs for personal and business use, as well as investment opportunities. Why set up. short sale) using the value of the margin account as collateral. Caution Investors sometimes use limit orders or sell stop orders (sometimes. Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad. This model makes the assumption that we are always able to service our margin loan. Even if we don't lose our main income stream. investment and non-investment needs. Margin borrowing can be used to satisfy short-term liquidity needs similar to how you may use a home equity line of. Trading options, futures, and short selling. Margin accounts offer a broader spectrum of investment choices compared to cash accounts. Investors can engage in. The most significant advantage of using margin is the ability to leverage your investments and increase the returns when the price of your holdings is moving. Therefore, buying on margin is mainly used for short-term investments. The longer you hold an investment, the greater a return you need to break even. A. Margin trading can be a complex investment strategy for beginner and even advanced investors. Use our margin trading education hub to learn about the basics. There's no set repayment schedule as long as you maintain the required level of equity in the account. To meet short-term cash flow needs, taking a margin loan. You can borrow against the value of your securities to buy additional securities or short sell securities. There are significant risks involved with borrowing. More investing options: With a margin account, you can short a stock or try different stock option strategies. Tax deductible: Interest on margin loans may be.

Where Can Exchange Foreign Currency

From ordering foreign currency cash to sending international wire transfers, Wells Fargo's foreign exchange can help you prepare for your next international. If you're engaged in international business, Regions offers a full suite of foreign exchange services to help you navigate the global economic landscape. Banks, credit unions, online bureaus, and currency converters provide convenient and often inexpensive currency exchange services. Once on foreign soil, the. AAA has over 70 types of foreign currency available for purchase before you travel so you'll be prepared for taxis, tips, and souvenir shopping. Top Banks That Exchange Foreign Currencies · Bank of America Currency Exchange: Customers of Bank of America have online and telephone exchange options for. Please call us at with any questions, such as types of foreign currency available, current exchange rates*, minimum amounts necessary to order, and. Exchange foreign currency for international travels with Fifth Third Bank. Order foreign currency, see currency exchange transaction fees, and more. CXI has many customer locations throughout North America where clients can exchange foreign currency. With a service network of more than company-owned. Wells Fargo account holders can order foreign currency cash online, or at a branch, and have delivery within business days. We do not buy back all. From ordering foreign currency cash to sending international wire transfers, Wells Fargo's foreign exchange can help you prepare for your next international. If you're engaged in international business, Regions offers a full suite of foreign exchange services to help you navigate the global economic landscape. Banks, credit unions, online bureaus, and currency converters provide convenient and often inexpensive currency exchange services. Once on foreign soil, the. AAA has over 70 types of foreign currency available for purchase before you travel so you'll be prepared for taxis, tips, and souvenir shopping. Top Banks That Exchange Foreign Currencies · Bank of America Currency Exchange: Customers of Bank of America have online and telephone exchange options for. Please call us at with any questions, such as types of foreign currency available, current exchange rates*, minimum amounts necessary to order, and. Exchange foreign currency for international travels with Fifth Third Bank. Order foreign currency, see currency exchange transaction fees, and more. CXI has many customer locations throughout North America where clients can exchange foreign currency. With a service network of more than company-owned. Wells Fargo account holders can order foreign currency cash online, or at a branch, and have delivery within business days. We do not buy back all.

Yes, Huntington customers can exchange foreign currency at any Huntington branch for an $15 fee per order. It typically takes three business days for your. Visit any of our banking centers to buy select currencies, with same-day service in certain branches and next-day service in our other locations. Orders will be. You can lock into an exchange rate and order or sell foreign currency notes at any bank branch. You can visit any one of our plus International Banking. Visit one of Prosperity Bank's Banking Centers to exchange your foreign currency today! Learn more. Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days · Exchange foreign currency for U.S. dollars when. Visions is partnering with Currency Exchange International, a foreign exchange to buy foreign currency. Through this easy to navigate online system. Top 10 Best Foreign Currency Exchange in New York, NY - August - Yelp - Currency Exchange International, A&S Foreign Exchange, Chase Bank, Uno Forex. Planning a trip abroad? Fifth Third Bank offers secure foreign currency exchange services so you have one less thing to worry about. Visit your local Fifth. Our members can buy and sell currency for over countries at any America First branch. And when you convert your cash ahead of time, you won't have to worry. CXI has many customer locations throughout North America where clients can exchange foreign currency. With a service network of more than company-owned. CXI has many convenient locations across the United States. In Manhattan, New York we exchange foreign currency, and sell gold bullion coins with great. Any Bank of America customer can exchange foreign currency at any financial center. Why are some currencies not listed on your site? Bank of America uses many. Having foreign currency available from the start of your trip makes it easier to get around when you go abroad. Exchange your dollars at any KeyBank branch, so. How to order foreign currency online You can order your currency via the mobile app or online banking. Exchange rates are updated daily and displayed at the. Zions Bank is your reliable service provider for buying and selling foreign currency bank notes. Find details about how to exchange currency here. How do I exchange or sell my foreign currency? To exchange or sell your foreign currency visit a U.S. Bank branch and we'll help you through the process. We. It's always smart to have cash on hand when you travel internationally. Central Bank offers convenient and cost-effective foreign exchange currency. Travelers can order currency while at the bank conducting other business. Travelers can sell back any unused currency at competitive rates of exchange. With. Find a branch location near you to order foreign currency cash for delivery in business days. Our branches no longer have foreign currency cash on-hand. Purchases – An American Savings Bank checking, money market or savings account is required for foreign currency purchases. A U.S. dollar equivalent service fee.

Ark Innovation Eft

ARK Innovation ETF is an actively managed exchange-traded fund incorporated in the USA. The Fund will invest in equity securities of companies relevant to. ARK Innovation ETF advanced ETF charts by MarketWatch. View ARKK exchange traded fund data and compare to other ETFs, stocks and exchanges. ARKK Performance - Review the performance history of the ARK Innovation ETF to see it's current status, yearly returns, and dividend history. The Leverage Shares +3x Long ARK Innovation ETP seeks to provide +3x leveraged exposure to ARKK. ARKK - BMO ARK Innovation Fund ETF Series. More about this fund: Overview, Price & Performance, Fund Details, ESG Information, Tax & Distributions, Holdings. Learn everything you need to know about ARK Innovation ETF (ARKK) and how it ranks compared to other funds. Research performance, expense ratio, holdings. Interactive Chart for ARK Innovation ETF (ARKK), analyze all the data with a huge range of indicators. The ARK Innovation ETF (ARKK) is the flagship actively-managed fund from the team at ARK Invest. The advisory firm, led by Catherine Wood, has an impressive. The Fund is an actively-managed exchange-traded fund that will invest under normal circumstances primarily (at least 65% of its assets) in domestic and foreign. ARK Innovation ETF is an actively managed exchange-traded fund incorporated in the USA. The Fund will invest in equity securities of companies relevant to. ARK Innovation ETF advanced ETF charts by MarketWatch. View ARKK exchange traded fund data and compare to other ETFs, stocks and exchanges. ARKK Performance - Review the performance history of the ARK Innovation ETF to see it's current status, yearly returns, and dividend history. The Leverage Shares +3x Long ARK Innovation ETP seeks to provide +3x leveraged exposure to ARKK. ARKK - BMO ARK Innovation Fund ETF Series. More about this fund: Overview, Price & Performance, Fund Details, ESG Information, Tax & Distributions, Holdings. Learn everything you need to know about ARK Innovation ETF (ARKK) and how it ranks compared to other funds. Research performance, expense ratio, holdings. Interactive Chart for ARK Innovation ETF (ARKK), analyze all the data with a huge range of indicators. The ARK Innovation ETF (ARKK) is the flagship actively-managed fund from the team at ARK Invest. The advisory firm, led by Catherine Wood, has an impressive. The Fund is an actively-managed exchange-traded fund that will invest under normal circumstances primarily (at least 65% of its assets) in domestic and foreign.

Cathie Wood buys $ million of two rising tech stocks. Her flagship Ark Innovation ETF has sunk 14% year to date. View the latest ARK Innovation ETF (ARKK) stock price and news, and other vital information for better exchange traded fund investing. Introduction to the Tradr Short Innovation Daily ETF (Nasdaq ticker SARK), which is a short inverse exposure to the ARK Innovation Fund (ARKK). The portfolio of Cathie Wood updated daily. These are the positions, trades, and weight of all companies in her ARKK Innovation ETF. Get the latest ARK Innovation ETF (ARKK) real-time quote, historical performance, charts, and other financial information to help you make more informed. ARKK, ARK Innovation ETF - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. ARK Innovation ETF. . . 1D. 1W. 1M. 3M. YTD. 1Y. 5Y. ALL. Why Robinhood? Robinhood innovation. Index-Tracked. Index-Tracked. Category. Mid-Cap Growth. About ARK Innovation ETF ARKK is full of cutting-edge firms, selected to represent the advisers highest-conviction investment ideas in this space. The adviser. ARK Innovation ETF ARKK has $0 invested in fossil fuels, 0% of the fund. The ETF provides exposure to an actively managed portfolio by ARK Investment Management LLC. The ETF's % annualized gain was a solid absolute return but puny relative to technology-focused funds — its closest peers — which averaged around 15% gains. All 38 ARKK ETF Holdings. The portfolio of Cathie Wood updated daily. These are the positions, trades, and weight of all companies in her ARKK Innovation ETF. These are the positions, trades, and weight of all companies in her ARKK Innovation ETF. Follow @CathiesArk on TwitterCathie's Ark is not affiliated with ARK. ARK Invest focuses solely on disruptive innovation and offers investment solutions to investors seeking long-term growth in the public markets. Find the latest quotes for ARK Innovation ETF (ARKK) as well as ETF details, charts and news at imprimermonlivre.ru Complete ARK Innovation ETF funds overview by Barron's. View the ARKK funds market news. Real time Ark ETF Trust - Ark Innovation ETF (ARKK) stock price quote, stock graph, news & analysis. ARK Innovation ETF exchange traded fund overview and insights. Find here information about the ARK Innovation ETF (ARKK). Assess the ARKK stock price quote today as well as the premarket and after hours trading prices. What. Ark Innovation Etf (ARKK) Holdings - View complete (ARKK) ETF holdings for better informed ETF trading.

I Want To Sell My Own House

While many still use real estate agents to help them complete this process, it's not necessary and more and more sellers are choosing to do this on their own. You could also consider renting out your house to tenants, effectively becoming a landlord. Finally, you can also sell your house to quick house sale buying. What Are the Benefits of Selling Your House On Your Own? The primary reason that people choose to sell their house without a realtor is usually to save money. FSBO homes typically sell for about 24% less than those listed with agents, which may outweigh the money you save doing it all on your own.[1] While you're not. 1. Determine a price. Before listing your house for sale, you'll need to determine how much you think it's worth to a potential buyer. When you sell a rent to own you can have an increased sales price and because there is no real estate agents involved, you will save on that 6% commission. You. FSBO homes typically sell for about 23% less than those listed with agents, which may outweigh the money you save doing it all on your own.[1] While you're not. Listing your own property—and finding the right buyer—can be difficult and time-consuming. That's because most homebuyers work with real estate agents who have. 1. Evaluate the current market · 2. Choose your list price · 3. Prepare and stage your house · 4. Take listing photos · 5. List your home online · 6. Further market. While many still use real estate agents to help them complete this process, it's not necessary and more and more sellers are choosing to do this on their own. You could also consider renting out your house to tenants, effectively becoming a landlord. Finally, you can also sell your house to quick house sale buying. What Are the Benefits of Selling Your House On Your Own? The primary reason that people choose to sell their house without a realtor is usually to save money. FSBO homes typically sell for about 24% less than those listed with agents, which may outweigh the money you save doing it all on your own.[1] While you're not. 1. Determine a price. Before listing your house for sale, you'll need to determine how much you think it's worth to a potential buyer. When you sell a rent to own you can have an increased sales price and because there is no real estate agents involved, you will save on that 6% commission. You. FSBO homes typically sell for about 23% less than those listed with agents, which may outweigh the money you save doing it all on your own.[1] While you're not. Listing your own property—and finding the right buyer—can be difficult and time-consuming. That's because most homebuyers work with real estate agents who have. 1. Evaluate the current market · 2. Choose your list price · 3. Prepare and stage your house · 4. Take listing photos · 5. List your home online · 6. Further market.

One of the most important aspects of selling is finding a great listing agent. Talk to a few agents before choosing one. Ask which homes they've sold in. Another advantage to FSBO is scheduling showings. For a seller who needs to show the home on their schedule, it's much easier to manage your own timeline rather. But if the housing market in your specific area is relatively slow, updating the kitchen and bathrooms may make it stand out from other homes, helping it to. Today you can sell your home on your own terms, selecting a method that suits your budget, timeframe and financial goals. If you sell your house online, you can. Start your house selling journey with Zillow's expertise. Pick the best home selling option for you: sell with a Zillow partner agent, get a cash offer. Recent sales in your neighborhood; Comparable houses, or comps, in your area · Do a deep clean of the house. Steam carpets, vacuum, declutter, wipe down and dust. When you sell a rent to own you can have an increased sales price and because there is no real estate agents involved, you will save on that 6% commission. You. If you need to sell your property fast, listing with a Realtor isn't always an option. Foreclosure, behind on taxes, behind on mortgage payment, divorce, fed up. Agent Fees: Sellers typically pay % of the home sale price, split between their agent and the buyer's agent. · Closing Costs: Closing costs can be negotiated. 1. Determine the Right Price for Your Home Based on Market Conditions · 2. Get Your House Ready for Sale · 3. Promote, Promote, Promote! · 4. Negotiate with Buyers. Advertise online. Put an ad for your home on a website like Craigslist. Take out classified ads in your local newspaper and ask if they'll be available on a. However, listing your house as “for sale by owner” (FSBO) means you won't need to pay extra commission to a real estate agent — 6% of the selling price is. They negotiate the price on your behalf. Their facilitations ensure that you get the best profitable deal from the sale of your home. Doing it on your own may. What's a big mistake many homeowners make when selling their own house themselves? For-Sale-By-Owners tend to sell their homes for lower prices than homes sold. Opendoor is the new way to sell your home. Skip the hassle of listing, showings and months of stress, and close on your own timeline. 1. Get Your Home Ready · 2. Research the Market and Set Your Price · 3. Gather Information and Draft Your Listing · 4. List Your Home on the MLS · 5. Advertise. Sell My House: List For Sale By Owner Homes & Private House Sales. We assist want to complete before embarking on your mission to Sell your own Home. However, listing your house as “for sale by owner” (FSBO) means you won't need to pay extra commission to a real estate agent — 6% of the selling price is. Selling your home through a realtor has its perks, but it comes with hefty listing agent commissions and fees in addition to the buyer's agent commissions. While many still use real estate agents to help them complete this process, it's not necessary and more and more sellers are choosing to do this on their own.

Enterprise Rm

enterprise risk management Definitions: The methods and processes used by an enterprise to manage risks to its mission and to establish the trust necessary. Enterprise Risk Management Framework. Risk is uncertainty that might result in a negative outcome or an opportunity. ERM is a disciplined process to identify. Enterprise risk management (ERM) is a framework for managing organizational risk, from ensuring employee safety and securing sensitive data to meeting. Enterprise risk management is used in strategic decision-making and tactical implementation. Enterprise risk management helps a business set worthy business and. Enterprise Risk Management (ERM) is an integrated and joined up approach to managing risk across an organisation and its extended networks. Member: $ / Non-member: $ Understanding the concepts of enterprise risk management is crucial in today's modern workplace. This essential body of. Enterprise risk management (ERM) is the process of planning, organizing, directing and controlling the activities of an organization to minimize the harmful. Enterprise Risk Management (ERM) is a rigorous approach to assessing and addressing risks from all sources that threaten the achievement of an. Risk management is a program designed to identify potential events that may affect the government and to protect and minimize risks to the government's property. enterprise risk management Definitions: The methods and processes used by an enterprise to manage risks to its mission and to establish the trust necessary. Enterprise Risk Management Framework. Risk is uncertainty that might result in a negative outcome or an opportunity. ERM is a disciplined process to identify. Enterprise risk management (ERM) is a framework for managing organizational risk, from ensuring employee safety and securing sensitive data to meeting. Enterprise risk management is used in strategic decision-making and tactical implementation. Enterprise risk management helps a business set worthy business and. Enterprise Risk Management (ERM) is an integrated and joined up approach to managing risk across an organisation and its extended networks. Member: $ / Non-member: $ Understanding the concepts of enterprise risk management is crucial in today's modern workplace. This essential body of. Enterprise risk management (ERM) is the process of planning, organizing, directing and controlling the activities of an organization to minimize the harmful. Enterprise Risk Management (ERM) is a rigorous approach to assessing and addressing risks from all sources that threaten the achievement of an. Risk management is a program designed to identify potential events that may affect the government and to protect and minimize risks to the government's property.

Enterprise risk management (ERM) is a holistic approach to identifying, defining, quantifying, and treating all of the risks facing an organization. As a Management Trainee, you will be. You'll be given real responsibility – and be expected to own it. We'll empower you to experience, explore and thrive. With. Enterprise Risk Management (ERM) plays a key role in the management of Stony Brook University's entire risk portfolio. We partner with many other campus. Enterprise risk management (ERM) is a methodology that looks at risk management strategically from the perspective of the entire firm or organization. ERM provides a framework for risk management, which typically involves identifying particular events or circumstances relevant to the organization's objectives. ERM provides a framework for risk management, which typically involves identifying particular events or circumstances relevant to the organization's objectives. Enterprise risk management provides a proactive, strategic and holistic methodology to managing both risk and opportunity across the entire organization. Baker. This supplement, titled COSO Enterprise Risk Management - Integrating with Strategy and Performance: Compendium of Examples, was developed from industry. Traditional Risk Management allows department heads to make decisions autonomously, but this can lead to conflicting risk priorities and strategies. ERM. Health Care Enterprise Risk Management Playbook, Second Edition Operationalize Enterprise Risk Management (ERM) for your organization, with concepts. With MetricStream Enterprise Risk Management, organizations can: Cut down the cycle time and costs of performing risk assessments and improve resource. The 8 Components of Enterprise Risk Management · 1. Internal Environment · 2. Objective Setting · 3. Event Identification · 4. Risk Assessment · 5. Risk. Enterprise Risk Management (ERM) Resources. Enterprise Risk Management (ERM) provides a framework for achieving safe, reliable health care, and is a key ASHRM. The Office of Enterprise Risk Management (ERM), permanently established in January , leads the Office of Inspector General's (OIG) efforts in recognizing. Foundational elements of enterprise risk management — breaking E-R-M down. Alignment with corporate strategy; Risk strategy and governance; A common risk. Steps in the Enterprise Risk Management (ERM) Process · Assess Risks After identifying the risks, the next step is to assess their likelihood and potential. The Master of Science in Enterprise Risk Management (ERM) program at Columbia University prepares graduates to inform better risk-reward decisions by providing. Enterprise Risk Management - The latest news about Enterprise Risk Management from the WSJ Risk & Compliance Journal Blog. Risk management, strategy and. Enterprise Risk Management (“ERM”) is a strategic business discipline that supports the achievement of an organization's objectives by addressing the full. The goal is to have appropriate risk management processes, and systems, to identify challenges and risks early and bring them to the attention of Agency.

Define Stock Options

Stock options are, in short, the ultimate forward-looking incentive plan—they measure future cash flows, and, through the use of vesting, they measure them in. choice, option, alternative, preference, selection, election mean the act or opportunity of choosing or the thing chosen. choice suggests the opportunity or. A stock option is a contract between two parties that gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified. An employee stock ownership plan (ESOP) is a retirement plan in which an employer contributes its stock to the plan for the benefit of the company's. Stock Options Definition Stock options are a form of compensation where employees have the right to purchase a certain amount of the company's shares for a. Stock options are assets often given to employees as a part of their compensation package at a discounted price. · Employee stock options vary based upon type. Stock options are, in short, the ultimate forward-looking incentive plan—they measure future cash flows, and, through the use of vesting, they measure them in. Employee stock options (ESO) is a label that refers to compensation contracts between an employer and an employee that carries some characteristics of. What is a stock option? A stock option gives an employee the right to purchase a share at a fixed price for a specified period of time. For the senior engineer. Stock options are, in short, the ultimate forward-looking incentive plan—they measure future cash flows, and, through the use of vesting, they measure them in. choice, option, alternative, preference, selection, election mean the act or opportunity of choosing or the thing chosen. choice suggests the opportunity or. A stock option is a contract between two parties that gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified. An employee stock ownership plan (ESOP) is a retirement plan in which an employer contributes its stock to the plan for the benefit of the company's. Stock Options Definition Stock options are a form of compensation where employees have the right to purchase a certain amount of the company's shares for a. Stock options are assets often given to employees as a part of their compensation package at a discounted price. · Employee stock options vary based upon type. Stock options are, in short, the ultimate forward-looking incentive plan—they measure future cash flows, and, through the use of vesting, they measure them in. Employee stock options (ESO) is a label that refers to compensation contracts between an employer and an employee that carries some characteristics of. What is a stock option? A stock option gives an employee the right to purchase a share at a fixed price for a specified period of time. For the senior engineer.

Options are essentially contracts between two parties that give holders the right to buy or sell an underlying asset at a certain price within a specific. An equity option is issued as a call or a put which determines if the contract contains the right to buy (call) or the right to sell (put). An option is a derivative security because it derives its value from an underlying security such as a stock. While investors can certainly trade options along. Employee stock options are an employee benefit that allow employees the ability to purchase company stock in the future at a set price, currently the market. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. One options contract typically represents the right to buy or sell shares of the specified stock. How Do Options Contracts Work? An options contract's. Stock options call for investors to essentially speculate on how a particular stock market price will rise or fall. Definition and application · An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified. Stock options allow you to save cash instead of spending money on high salaries. It can also motivate employees to stay and make your company a success. Exercising stock options refers to an employee purchasing shares in the company for which they work. These options are granted to them as part of their. An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike price on or before a. Options granted under an employee stock purchase plan or an incentive stock option (ISO) plan are statutory stock options. Stock options that are granted. An option is a contract giving the buyer the right, but not the obligation, to buy or sell an underlying asset (a stock or index) at a specific price on or. An option is a contract between prospective buyers and sellers of stocks. The option writer puts a contract up for sale on an options market, offering to sell. An option grant is a right to acquire a set number of shares of stock of a company at a set price. Organisations may offer equity-based compensation to their employees in the form of stock options. Companies grant employee stock options with the expectation. For equity options, the underlying instrument is a stock, ETF or similar product. The contract itself is very precise. It establishes a specific price. An option grant is a right to acquire a set number of shares of stock of a company at a set price. Stock option definition: an option giving the holder, usually an officer or employee, the right to buy stock of the issuing corporation at a specific price. How can I buy stock options? To buy stock options, you need to open a brokerage account, understand key terms like strike price and premium, choose between call.

Average American Car Payment

Board of Governors of the Federal Reserve System (US), Average Amount Financed for New Car Loans at Finance Companies [DTCTLVENANM], retrieved from FRED. America's Car-Mart is a buy here pay here used car dealership. Shop quality used vehicles, apply for used car financing and value your trade. The average monthly vehicle payment in the United States is $ for new cars and $ for used cars as of The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. Average monthly car payment in US is over $!!! How the bleep do people do that? An old car with high mileage is gonna cost me at least $/. The average price of a new car is more than $, and used cars go for about $—but fuel, insurance, and more also factor into how much you should. The average monthly payment for new car loans has grown to $, up from $ and $ in Q4 and Q4 , respectively. For used car loans, Americans are. Apply for a new or used car loan or refinance your existing auto loan at Bank of America A lower monthly payment doesn't always mean you're saving money. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. Board of Governors of the Federal Reserve System (US), Average Amount Financed for New Car Loans at Finance Companies [DTCTLVENANM], retrieved from FRED. America's Car-Mart is a buy here pay here used car dealership. Shop quality used vehicles, apply for used car financing and value your trade. The average monthly vehicle payment in the United States is $ for new cars and $ for used cars as of The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. Average monthly car payment in US is over $!!! How the bleep do people do that? An old car with high mileage is gonna cost me at least $/. The average price of a new car is more than $, and used cars go for about $—but fuel, insurance, and more also factor into how much you should. The average monthly payment for new car loans has grown to $, up from $ and $ in Q4 and Q4 , respectively. For used car loans, Americans are. Apply for a new or used car loan or refinance your existing auto loan at Bank of America A lower monthly payment doesn't always mean you're saving money. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit.

Whether you're buying a new or used car, refinancing your current loan or leasing a vehicle, U.S. Bank has options for your financing journey. The average down payment amount on a used vehicle is up to $3,, 7% higher than in the first quarter of The average amount down on a new car is up 27%. GM Financial offers a variety of auto finance options to help you get behind the wheel of a new or used car, truck or SUV — and we look beyond your credit. The average car payment for a new vehicle is $ monthly, according to first-quarter data from Experian — up % year over year. Experian reports, Opens overlay that, as of the first quarter of , new vehicle owners paid an average of $ a month on their vehicles, while used car. The average monthly vehicle payment in the United States is $ for new cars and $ for used cars as of Back in , the reported estimated average transaction price for a light vehicle in the United States was $37, Spending more than $40, for a new car if. The average monthly payment for new car loans has grown to $, up from $ and $ in Q4 and Q4 , respectively. For used car loans, Americans are. Most drivers can tell you what they paid for their car and maybe even what it costs to keep the gas tank full. But the true annual costs of new vehicle. The countrywide average auto insurance expenditure increased percent to $1, in from $1, in , according to the National Association of. The average new car owner with an auto loan pays $ per month, according to data from the credit bureau Experian. While it doesn't tell us how many years the. Experian reports, Opens overlay that, as of the first quarter of , new vehicle owners paid an average of $ a month on their vehicles, while used car. These are the average auto loan rates by state, as determined by Edmunds data. Click on a state to view the APR for different vehicle types. Average Used Auto Loan Rates in July ; or higher, % ; , % ; , % ; , % ; or lower, %. Why choose us for your car loan? Our car loans are meant to be flexible and Members who switched to USAA Auto Insurance saved an average of $ a year. The average price of a new car is more than $, and used cars go for about $—but fuel, insurance, and more also factor into how much you should. In , the American Automobile Association adopted a new method for calculating vehicle operating costs that represent the real-world personal use of a. Tell us how you want to pay: Pick a weekly, bi-weekly or monthly payment plan. Change how much you pay*, how often, or even what days you make a payment. Now is a great time to get fast financing from America First, because when you apply for an auto loan, you'll make no payments* for the first 90 days. The fact is that most Americans who like to have new cars don't care about anything but the monthly payment. So the manufacturers, dealers, and.

1 2 3 4 5