imprimermonlivre.ru Market

Market

Buy Startup Stocks

One way to invest in a startup is to buy shares during the initial public offering (IPO). With an IPO, the company takes its shares public on a stock exchange. Dear SaaStr: Should I Buy My Stock Options After Leaving a Startup? · If the company is doing well (i.e., revenue growing quickly, not burning too much); and. Sushant Bharti · 1. Existing valuation of the company · 2. Methodology adopted to reach the valuation · 3. Nature of equity on offer (Sweat etc) · 4. Probable. Stocks are available for companies in a wide variety of industries, so you can tap into your knowledge of specific businesses. They can also help you diversify. Build your portfolio starting with just $1. Invest in stocks, options, and ETFs at your pace and commission-free. Yes. In the United States, if you meet the requirements to be considered a qualified investor, you can buy stocks of a company before their. This guide explains the foundations of startup stock options, specifically in early stage startups where employee equity is every startup founder's (not so). EquityZen is the marketplace for accessing Pre-IPO equity. Invest in or sell shares via EquityZen funds. Invest in founders building the future. Get equity and front row seats to the startups and small businesses you love—for as little as $ One way to invest in a startup is to buy shares during the initial public offering (IPO). With an IPO, the company takes its shares public on a stock exchange. Dear SaaStr: Should I Buy My Stock Options After Leaving a Startup? · If the company is doing well (i.e., revenue growing quickly, not burning too much); and. Sushant Bharti · 1. Existing valuation of the company · 2. Methodology adopted to reach the valuation · 3. Nature of equity on offer (Sweat etc) · 4. Probable. Stocks are available for companies in a wide variety of industries, so you can tap into your knowledge of specific businesses. They can also help you diversify. Build your portfolio starting with just $1. Invest in stocks, options, and ETFs at your pace and commission-free. Yes. In the United States, if you meet the requirements to be considered a qualified investor, you can buy stocks of a company before their. This guide explains the foundations of startup stock options, specifically in early stage startups where employee equity is every startup founder's (not so). EquityZen is the marketplace for accessing Pre-IPO equity. Invest in or sell shares via EquityZen funds. Invest in founders building the future. Get equity and front row seats to the startups and small businesses you love—for as little as $

In the world of startups, not all shares are created equal. The VCs who finance unproven companies will insist on contractual agreements that mitigate the. Buy and sell shares on our new Secondary market trading platform · Deposit and withdraw funds from an SIPC insured Investment Account · Initiate investments with. Unlike par value, your common stock's value is based on your startup's value, which, if things go well, this value goes up over time. Meanwhile, Apple is in talks to invest in OpenAI as part of a new funding round that would value the startup at over $ billion. How to Buy Stocks · How to. A leading startup employees stock options funding platform, empowering startup employees and accredited investors to unlock the value of startup equity. Invest in European tech startups. Build your investment portfolio with VC-backed opportunities, from pre-seed to Series B+, and secondary market. AngelList builds the infrastructure that powers the startup economy—providing investors and innovators with the tools to grow Equity Management. Equity. On Republic, anyone can invest in startups. Become an investor in cutting-edge private companies with as little as $ Startup investing can be a great option to diversify any portfolio or to claim a stake in up-and-coming startups before they hit the stock market. How to invest in startups. Learn about the startup ecosystem; Understand the risks and rewards of startup investing; Assess your readiness; Define your. Invest in vetted startups, buy and sell private stock, or raise capital through equity crowdfunding with MicroVentures. This article details guidelines to help investors navigate the often thorny penny stock minefield. By doing so, investors are forming a partnership with the startups they choose to invest in – if the company turns a profit, investors make returns. Unlike par value, your common stock's value is based on your startup's value, which, if things go well, this value goes up over time. Top Penny Stock Losers ; BIG. Big Lots ; WHLR. Wheeler Real Estate Investment ; HYZN. Hyzon Motors ; OVID. Ovid Therapeutics ; TOVX. Theriva Biologics. A penny stock is loosely categorized by the Securities and Exchange Commission as one that trades for less than $5 per share. OurCrowd's platform gives accredited investors access to venture debt, private equity indexes, and other sought-after alternative credit assets. In the world of startups, not all shares are created equal. The VCs who finance unproven companies will insist on contractual agreements that mitigate the. The most common equity vehicle, especially at early-stage startups, is the stock option. It's the option to buy a certain # of shares at a set price, aka the. Shares is the investment platform empowering you to become a smarter investor. Invest in over stocks and learn from current investors.

Debit Cr

As a matter of accounting convention, these equal and opposite entries are referred to as debit (Dr) and credit (Cr) entries. For every debit recorded, there. Recieve 1% unlimited cash back with the Serve Cash Back Visa debit card or enjoy free cash reloads with the Serve Free Reloads Visa debit card. A debit records financial information on the left side of each account. A credit records financial information on the right side of an account. The main difference between credit cards and debit cards comes down to whether you're borrowing from a line of credit or using your own money. Get the best debit and credit card offers for your financial needs. Join Priority Trust now. DR stands for "debit record" and CR stands for "credit record".Some even believe the DR notation is short for "debtor" and CR is short for "creditor". For every debit that is recorded, there must be an equal amount (or sum of amounts) entered as a credit. For example, if there are debit entries which total. Safe Debit account, Savings accounts, Money market accounts, CDs, Debit Cards, Visa gift cards, Mobile & online features. Debit is giving value to an account. Credit is taking value from an account. So liabilities and equity decrease when you give value (debit) to them. As a matter of accounting convention, these equal and opposite entries are referred to as debit (Dr) and credit (Cr) entries. For every debit recorded, there. Recieve 1% unlimited cash back with the Serve Cash Back Visa debit card or enjoy free cash reloads with the Serve Free Reloads Visa debit card. A debit records financial information on the left side of each account. A credit records financial information on the right side of an account. The main difference between credit cards and debit cards comes down to whether you're borrowing from a line of credit or using your own money. Get the best debit and credit card offers for your financial needs. Join Priority Trust now. DR stands for "debit record" and CR stands for "credit record".Some even believe the DR notation is short for "debtor" and CR is short for "creditor". For every debit that is recorded, there must be an equal amount (or sum of amounts) entered as a credit. For example, if there are debit entries which total. Safe Debit account, Savings accounts, Money market accounts, CDs, Debit Cards, Visa gift cards, Mobile & online features. Debit is giving value to an account. Credit is taking value from an account. So liabilities and equity decrease when you give value (debit) to them.

It means an increase in assets. All accounts that normally contain a debit balance will increase in amount when a debit (left column) is added to them and. Debit vs. credit: What are the advantages of having one or the other? Both? Learn more about the difference between debit and credit cards and which is best. Paymentus Card Payment Information You can use a credit or debit card to pay a balance due on an individual income tax return, individual estimated tax. Whether a debit or credit means an increase or decrease in an account depends on the account type. In traditional double-entry accounting, debits are entered on. Debits and credits are used in a company's bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability. Debits and credits are terms used by bookkeepers and accountants when recording transactions in the accounting records. The amount in every transaction must be. If you are looking for a personal finance app that is convenient, easy to use and at the same time has enough features, then Debit & Credit is the right app. You always enter debits on the left-hand side of the account. Assets are on the left-hand side of the balance sheet. As a result, increases in assets are debits. This article explains the sign of the debit and credit transactions from your corporate card statement during their import on Fyle. To debit an account means to post an entry to the left side of the account and to credit an account means to post an entry to the right side of the account. Is accounts payable a debit or a credit? Accounts payable is a liability account, which represents the amount of money a company owes to its vendors or. Debits are viewed as money drawn from our bank account, and credits are viewed as money available to spend or borrow from the bank. Shop safely with Capital One's contactless debit card—no need for cash or checks. $0 fraud liability, access to + ATMs, and more hassle-free benefits. To record expenses in the financial statements, you would debit the expense account. A credit reduces an expense account. Debit means incoming money and credit means money leaving, right? Assets [Dr] = Liabilities [Cr] + Owner, Capital [Cr] - Owner, Withdrawals [Dr] + Revenues [Cr]. Debit card A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually. Knowing when to debit or credit just requires knowing three things. The Type of Account, whether the account Increases or Decreases, and the Account's Normal. The answer I got was that, Cr, used as an abbreviation for credit is actually a short form of 'Cedere' a Latin word meaning 'to believe'. Make your tax payments by credit or debit card. You can pay online, by phone or by mobile device no matter how you file. Learn your options and fees that.

How Many Subs To Go Live On Youtube

How Many Videos Do You Need to Get 1, Subscribers. You don't need a set number of videos to get 1, subscribers. Some channels hit that milestone with just. Streamlabs is the best streaming platform for Twitch, YouTube & Facebook. Grow with Streamlabs Desktop, alerts, overlays, tipping & merch. Mobile: To go live from your mobile device, like a phone or tablet, you need to have a verified YouTube channel with at least 50 subscribers. This is a good. Broadcasting requires that you link accounts such as YouTube or Twitch to your account for PlayStation™Network. When you're all set, select Go Live, and your. For fully unrestricted mobile streaming on YouTube you can have 25 + your subscribers, the the amount of viewers, the vod will be automatically. How many followers do you need to go live on TikTok? To access the Live feature on the TikTok app, you must have at least followers. To access some of. YouTube channels with 50 subscribers can now access mobile live streaming. There is a catch, mobile live streaming under 1, subscribers gets. imprimermonlivre.ru 2 more links. Subscribe. Home. Videos. Live. Playlists. Community. Search. Escaping to Japan's Secret Paradise *Okinawa* · Videos. With YouTube Live, creators can create in-the-moment experiences to reach their community. Explore this guide for more information on streaming. How Many Videos Do You Need to Get 1, Subscribers. You don't need a set number of videos to get 1, subscribers. Some channels hit that milestone with just. Streamlabs is the best streaming platform for Twitch, YouTube & Facebook. Grow with Streamlabs Desktop, alerts, overlays, tipping & merch. Mobile: To go live from your mobile device, like a phone or tablet, you need to have a verified YouTube channel with at least 50 subscribers. This is a good. Broadcasting requires that you link accounts such as YouTube or Twitch to your account for PlayStation™Network. When you're all set, select Go Live, and your. For fully unrestricted mobile streaming on YouTube you can have 25 + your subscribers, the the amount of viewers, the vod will be automatically. How many followers do you need to go live on TikTok? To access the Live feature on the TikTok app, you must have at least followers. To access some of. YouTube channels with 50 subscribers can now access mobile live streaming. There is a catch, mobile live streaming under 1, subscribers gets. imprimermonlivre.ru 2 more links. Subscribe. Home. Videos. Live. Playlists. Community. Search. Escaping to Japan's Secret Paradise *Okinawa* · Videos. With YouTube Live, creators can create in-the-moment experiences to reach their community. Explore this guide for more information on streaming.

The key metrics to measure success on YouTube is through the number of subscribers your channel has. So how to increase youtube subscribers? The most common path to YouTube monetization is the YouTube Partner Program. Once you have 1, subscribers and over either 4, public watch hours or Youtube · Trovo · Kick · Nimo NimoTV · Bigo Live How many subs does caseoh_ have? caseoh_ has 40 active subscribers. How. How Do I Start a Subscriber Stream? · Visit your Creator Dashboard. · Select Subscribers under the Audience section of your Stream Information tab. · Moderators. To live stream on YouTube using your mobile device, you need to have at least 1, subscribers. However, if you plan to stream from a desktop. Mobile: To go live from your mobile device, like a phone or tablet, you need to have a verified YouTube channel with at least 50 subscribers. This is a good. Broadcasting requires that you link accounts such as YouTube or Twitch to your account for PlayStation™Network. When you're all set, select Go Live, and your. hi! I'm a streamer on YouTube! more more imprimermonlivre.ru 2 more links. Subscribe. Home. Videos. Shorts. Live. Playlists. Keeping tabs on how many YouTube subscribers you have can provide solid metrics for your success. But getting viewers to hit that subscribe button isn't the. YouTube Premium subscribers don't see ads on the platform, so when live events, and more, come build with Mighty! Mighty Networks is a powerful. Check real time subscriber count. Live Sub Count updated every second. To search for specific channel simply click "Change User" button below Follower Count Box, type your favorite creator's username and you're good to go! This. Everybody wants to use the TikTok live feature. However, the platform's requirement of having at least 1, followers can be a barrier for many aspiring. As of December , the average YouTube user watches 9 videos per visit. If they log in daily, they will watch around monthly videos and 3, videos per. Here's How It Works! ; Sign Up & Login. Start by creating an account and logging in. ; Add Funds. Visit the deposit page and complete the steps to make your. You'll be able to participate in the YouTube Partnership Program, begin monetizing your videos, and earn delightful passive revenue once you've reached this. Grow your channel with targeted video promotion. Get real views and subscribers fast with Sprizzy's advanced YouTube ad targeting. Live. Playlists. Community. Search. BEST OF TIMTHETATMAN (FUNNIEST MOMENTS) K subscribers · TimTheTatman VODs. @TimTheTatmanVODs. K subscribers. M posts. Discover videos related to How to Go Live on Youtube with 50 Subs on TikTok. See more videos about How to Make Youtube Subscription Public. Fastest YouTube channel to hit , subscribers, 22 minutes, 8/21/, UR A Short Peppa Pig Live Stream (shortest livestream on YouTube). Ratings.

Where To Bet For Boxing

Best Boxing Sportsbooks in · BetOnline Has The Top Betting Lines For Boxing · Bovada Is The Best All-Round Site For Boxing Betting · Bonuses At MyBookie. Go to one of the bedding windows and tell the man how much money you would like to bet on the boxer of your choice. He will take your money and. The best boxing betting sites include DraftKings, FanDuel, BetMGM and Caesars Sportsbook. What boxing events can you bet on with a. In this guide, we touch on the integral aspects of betting on boxing including scheduling, moneyline bets, round betting, method of victory betting, parlay. Our expert team has found that the below are the best betting sites for boxing, based on security, choice of bets and fights and welcome bonus offers. Bet on boxing with the best boxing odds for live matches and upcoming fights online at imprimermonlivre.ru Find the latest odds for boxing betting online now! BetOnline, Bovada, MyBookie, and 5Dimes (no longer an option in the US) have all had decent boxing coverage during COVID Maybe not FULL. Boxing Betting Odds · Joshua Buatsi. Willy Hutchinson. Caesars Sportsbook logo. Caesars Sportsbook logo. BetRivers (formerly Play Sugar House) logo. BetUS site to bet on boxing odds, they offer a first-time deposit match for new users along with the ability to use cryptocurrency for deposits. Best Boxing Sportsbooks in · BetOnline Has The Top Betting Lines For Boxing · Bovada Is The Best All-Round Site For Boxing Betting · Bonuses At MyBookie. Go to one of the bedding windows and tell the man how much money you would like to bet on the boxer of your choice. He will take your money and. The best boxing betting sites include DraftKings, FanDuel, BetMGM and Caesars Sportsbook. What boxing events can you bet on with a. In this guide, we touch on the integral aspects of betting on boxing including scheduling, moneyline bets, round betting, method of victory betting, parlay. Our expert team has found that the below are the best betting sites for boxing, based on security, choice of bets and fights and welcome bonus offers. Bet on boxing with the best boxing odds for live matches and upcoming fights online at imprimermonlivre.ru Find the latest odds for boxing betting online now! BetOnline, Bovada, MyBookie, and 5Dimes (no longer an option in the US) have all had decent boxing coverage during COVID Maybe not FULL. Boxing Betting Odds · Joshua Buatsi. Willy Hutchinson. Caesars Sportsbook logo. Caesars Sportsbook logo. BetRivers (formerly Play Sugar House) logo. BetUS site to bet on boxing odds, they offer a first-time deposit match for new users along with the ability to use cryptocurrency for deposits.

Yes, most bookies have round betting. You probably can't be too specific with scoring unless you go to the actual betting shop and ask the. We'll explain how to wager on boxing, break down the weight classes, and help you handicap your bets. Boxing Betting & Boxing Odds. Live Boxing Bets with Ladbrokes. Immerse yourself in the electrifying world of live boxing betting with Ladbrokes, where the. Bet on Boxing with Sky Bet. Browse the latest Boxing odds and offers, for a range of markets! ✓Boxing Betting ✓Matches ✓Potential Fights ✓RequestABet. Bet on Boxing with the best Odds, Lines, Futures & Parlays at BetMGM. Get in the ring and bet on all the major fights. Sign up today! Pinnacle offers the best Boxing odds and high limits for Boxing betting. Boxing betting odds. As one of the oldest. Parimatch offers enormous betting opportunities for enthusiasts who enjoy betting on boxing matches. You'll need to create an account and make a deposit to. We have compiled the best boxing betting sites and some important guidelines and recommendations so you can make the best boxing bets! Boxing betting online at Betway! With the latest Boxing odds and the most up-to-date markets. ✓Boxing Betting ✓Secure Payment ✓Cash Out ✓Bet In-Play. The world champions, the underdogs, the upsets and the knockouts: you'll find competitive boxing betting odds, boxing tips and analyze is at William Hill. There are many credible and reputable boxing betting sites online. But our recommended sportsbook for betting on boxing is Sportsbook. Sportsbook is a top-tier. These are the best sportsbooks for betting on boxing in New York and what we think they excel in. 1. FanDuel - Best For Boxing Market Coverage. The best boxing betting sites offer competitive odds, fun wagers, and lucrative bonuses. Use this guide to find out how and where to bet on boxing online. Betting on Boxing has never been easier. Betway offers some of the best betting lines and odds that make betting on Boxing easy and fun! How to bet on Misfits event Saturday? It depends where you are in the world. Elle Brooke seems to be suggesting that imprimermonlivre.ru will be. The upcoming staged (sparring) boxing match between Mike Tyson and Jake Paul in July that will most certainly end as a draw. Get the latest boxing odds at sport. We offer both pre-match wagers and live boxing betting online, so you can bet whilst the bout is going on. Bet on Boxing with Paddy Power and browse the Boxing betting odds on a wide range of markets. ✓Bet In-Play ✓Cash Out ✓Boxing Betting Offers. Interested in boxing betting or MMA betting? A good place to start is to familiarize yourself with boxing odds and learn how to bet on boxing! Learn how to bet on boxing with an exhaustive guide to all boxing bets, from simple moneyline bets to winning method bets to round by round prop bets.

Incentives To Open A Bank Account

Earn $ when opening an eligible Fifth Third checking account with qualifying activities.1 Offer expires September 30, See all terms & conditions. Your. How to earn your new account bonus up to $ all offer requirements. With HarborOne, you can step in to a banking experience where trust is our foundation. Receive a total of $1, or more in qualifying electronic deposits to your new checking account within 90 calendar days of account opening (the qualification. The $ cash bonus is considered interest and is subject to IRS and other tax reporting. The cash bonus can be revoked if the account is closed within twelve . KeyBank: $ annual bonus. You can earn an annual bonus of $ by opening a Key Select Checking account and having direct deposits of $60, or more go into. Open a high yield Benefits Checking account and you can receive a $ bonus.* Learn how easy it is to earn % APY* with Benefits Checking. Wells Fargo: Earn a $ bonus if you open an Everyday Checking account and receive $1, in qualifying electronic deposits within 90 days of opening your. Receive your $ bonus: You'll see the bonus in your checking account within days after you open your account. You may receive your bonus before this time. $ CHECKING OFFER: Start by opening a new eligible checking account today. See offer details. Earn $ when opening an eligible Fifth Third checking account with qualifying activities.1 Offer expires September 30, See all terms & conditions. Your. How to earn your new account bonus up to $ all offer requirements. With HarborOne, you can step in to a banking experience where trust is our foundation. Receive a total of $1, or more in qualifying electronic deposits to your new checking account within 90 calendar days of account opening (the qualification. The $ cash bonus is considered interest and is subject to IRS and other tax reporting. The cash bonus can be revoked if the account is closed within twelve . KeyBank: $ annual bonus. You can earn an annual bonus of $ by opening a Key Select Checking account and having direct deposits of $60, or more go into. Open a high yield Benefits Checking account and you can receive a $ bonus.* Learn how easy it is to earn % APY* with Benefits Checking. Wells Fargo: Earn a $ bonus if you open an Everyday Checking account and receive $1, in qualifying electronic deposits within 90 days of opening your. Receive your $ bonus: You'll see the bonus in your checking account within days after you open your account. You may receive your bonus before this time. $ CHECKING OFFER: Start by opening a new eligible checking account today. See offer details.

And then of course there's closing the accounts after you get your bonus, which can be several hoops to jump through in many cases. And you. Get a $ Bonus & Apple™ AirPods® with any New Checking account* · Discover the Right Checking Account For You. Open a New Checking Account and Earn $ · Deposit a minimum of $25 within 60 days from account opening · Make purchases of $ or more using a Provident debit. The SoFi bank account currently has the highest APY of any account on our list. Plus, it has one of the highest new customer bank bonus offers: up to $ SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. Many banks will often offer a sign-up bonus when opening a new account. For checking accounts specifically, these bonuses can be at least $ The best checking account offers typically have bonus amounts of at least $ However, this amount can sometimes be lower when the bonus offer has other. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking® account. Here's how to qualify to earn the $ annual cash bonus for Key Select Checking: Make qualified direct deposits. Direct deposit at least $60, over the. Each $50 bonus will be credited to your new personal checking account if all requirements are met by the end of your monthly statement cycle. To make it even. A bank sign-up bonus is a financial incentive offered by banks and credit unions to encourage people to open a new account. Typically, bonuses take the form of. A bonus to the tune of $ Yours to earn with a new TD savings account and qualifying activities. Open in minutes. If you're interested in opening a new personal checking account, it could pay to choose one offering a sign-up bonus. This is a one-time cash bonus that. Bonus Terms: In order to qualify for eligibility for a bonus, SoFi must receive at least one Direct Deposit (as defined below) from an Eligible Participant, the. A checking account promotion or other offer could certainly be an attractor if you need to open an account but aren't sure which bank to choose. You were. ATMs and financial centers where you need them. · Within 90 days of meeting the incentive requirements, $ will be deposited to the new Free Checking account. You may earn a $ or $1, reward if you open a new PNC Treasury Enterprise Plan or Analysis Business Checking account. To receive $ Open a new PNC. To earn a $ reward, receive two or more qualifying direct deposits totaling $7, or more within 90 days of opening your account · $ minimum initial. Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or military ID. · A minimum opening deposit of $ With the bonus, you can earn $ with a deposit of at least $25, or $ with a deposit of at least $15,, completed within 45 days of the account opening.

How To Get A Loan With Car As Collateral

If you're struggling to make ends meet, the key to getting the cash you need might be using your vehicle as collateral to secure a title loan. Auto Title Loans: Put the Brakes on Before You Get Caught in a Cycle of Debt or Lose Your Car An auto title loan is a short-term, high-rate cash loan where. If you own your vehicle and need cash fast, you could be eligible for an Auto Equity Loan. Use your car as collateral to secure a loan and get more money today! When you take out a car title loan, you are borrowing money and giving the lender the title to your car as collateral. This means that the lender can repossess. A car collateral loan, also known as a title loan or auto equity loan, is a type of secured loan where the borrower uses their vehicle as collateral to obtain. However, in the case of auto equity loans, you use the equity you have built up on your vehicle as collateral to secure financing. Here's what you need to know. If you want to get a loan using your car as collateral, then you'll likely have to provide your lender with the car's title while you're making loan repayments. To obtain a car title loan, you'll need to provide documentation verifying your identity, that you own your vehicle, and that you have earned income. To reduce. Yes, you can apply for a secured loan with bad credit. Secured loans are usually much more flexible than unsecured loans. If you're struggling to make ends meet, the key to getting the cash you need might be using your vehicle as collateral to secure a title loan. Auto Title Loans: Put the Brakes on Before You Get Caught in a Cycle of Debt or Lose Your Car An auto title loan is a short-term, high-rate cash loan where. If you own your vehicle and need cash fast, you could be eligible for an Auto Equity Loan. Use your car as collateral to secure a loan and get more money today! When you take out a car title loan, you are borrowing money and giving the lender the title to your car as collateral. This means that the lender can repossess. A car collateral loan, also known as a title loan or auto equity loan, is a type of secured loan where the borrower uses their vehicle as collateral to obtain. However, in the case of auto equity loans, you use the equity you have built up on your vehicle as collateral to secure financing. Here's what you need to know. If you want to get a loan using your car as collateral, then you'll likely have to provide your lender with the car's title while you're making loan repayments. To obtain a car title loan, you'll need to provide documentation verifying your identity, that you own your vehicle, and that you have earned income. To reduce. Yes, you can apply for a secured loan with bad credit. Secured loans are usually much more flexible than unsecured loans.

COLLATERAL LOANS. Different from an unsecured personal loan or auto loan, a collateral loan allows you to borrow against your vehicle You can still apply for. Collateral loans for cars are similar to home loans. In this instance, you'll use your vehicle as collateral to guarantee that you'll repay the loan according. REQUIREMENT FOR LOAN APPROVAL Get Loan Approved offers our customers the best car collateral loan options. Get the money you need today, pay off your. Personal Title Loans · Hassle-Free Eligibility. We don't do credit checks or employment verification, because we utilize your car as collateral! · Simple. Get a fast car title loan online from top loan providers in Canada. If you own your vehicle, you could get cash in as little as 24 hours. If you ever face a financial crisis, applying for a car collateral loan in Ontario is the right choice. You can borrow up to $50,, but you must own a loan/. With a vehicle equity loan, you can borrow up to % of your car's value. Knowing the amount of equity you've earned can help you estimate your potential loan. To use your car as collateral, you must have equity in the vehicle. Equity is the difference between what the car is worth and what you owe on it. For example. Can I use my car as collateral for a loan? Yes, as long as you meet our requirements, such as owning the car outright and providing the necessary documentation. Most passenger car makes and models can be used as collateral for a personal loan. To qualify, your car must be. If you want to use your car as collateral, we can let you know how much money you can borrow, your interest rate and your approximate loan repayment amount. In a nutshell · You may be able to use your car as collateral for a logbook loan, depending on the lender's criteria · Logbook loans can be more expensive and. Some lenders will accept vehicles as collateral if you have sufficient equity in your vehicle and wish to put up the title as security. A handful of banks will. Get between $2, and $18, when securing your loan with your car title. collateral. Fast funds. With direct deposit. Apply now. You're eligible if you. Car title loans are short-term, high-interest loans that let borrowers use their vehicle's title as collateral. Contact LoanMart at if you have questions about using a financed vehicle as collateral for a title loan. What Do You Need to Get a Car Title Loan. A common type of collateral loan is a car title loan, which means you put up your vehicle's equity to use as security for a loan. These title loans are great. Start by providing some basic information about yourself on our personal loan application. If we determine you may benefit from adding your car as collateral. Yes. Some banks refer to this as loans against car. It's best to check with your bank if they offer such an option for loans. A title loan is a loan that uses the value of your automobile to secure the loan, also known as collateral. You must provide the lender with your automobile.

Average Life Insurance Policy Premium

How much does whole life insurance cost? A $, whole life insurance policy costs an average of $ per month for a year-old non-smoker in good health. Term life insurance rates by age ; Female, 20, $ ; Male, 25, $ ; Female, 25, $ ; Male, 30, $ Apply today and lock in your rates ; Term - regular monthly rates. Premiums per $25, increment of coverage; Choose coverage amounts from $25, to. On average, you can expect to pay $83 per month for a $1 million, year term life insurance policy if you're a year-old woman who doesn't smoke. If you're. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. Find out the average cost of life insurance as well as what factors impact life insurance rates life insurance policy will be. The likelihood of. For example, a company with higher average life insurance rates may insure older policyholders, policyholders in poor health or a combination of the two. If you. Ultimately, it will cost the insurance company less money to pay out $, than it would to pay out $1 million, so the average cost of premiums would be much. How The Cost Of Life Insurance Is Determined. The premium rate for a life insurance policy is based on two underlying concepts: mortality and interest. How much does whole life insurance cost? A $, whole life insurance policy costs an average of $ per month for a year-old non-smoker in good health. Term life insurance rates by age ; Female, 20, $ ; Male, 25, $ ; Female, 25, $ ; Male, 30, $ Apply today and lock in your rates ; Term - regular monthly rates. Premiums per $25, increment of coverage; Choose coverage amounts from $25, to. On average, you can expect to pay $83 per month for a $1 million, year term life insurance policy if you're a year-old woman who doesn't smoke. If you're. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. Find out the average cost of life insurance as well as what factors impact life insurance rates life insurance policy will be. The likelihood of. For example, a company with higher average life insurance rates may insure older policyholders, policyholders in poor health or a combination of the two. If you. Ultimately, it will cost the insurance company less money to pay out $, than it would to pay out $1 million, so the average cost of premiums would be much. How The Cost Of Life Insurance Is Determined. The premium rate for a life insurance policy is based on two underlying concepts: mortality and interest.

Premium rate increases every five years as the insured reaches each new age band (25, 30, 35, 40, 45, 50, 55, 60, 65, 70 and 75). All coverage amounts may not. A year-old non-smoker would pay a $ monthly premium for the same policy.* By purchasing this policy at age 35 instead of 45, you could save $ per year. You can maintain the same coverage amount and manage the cost by changing the duration of the term. With TD Term Life Insurance, premiums are guaranteed and. The average premium for a life insurance policy in New Zealand varies depending on the age of the insured. Generally, younger individuals pay lower premiums as. If you're a healthy year-old looking for a year term life insurance policy, the average cost of monthly premiums is around $13 for $, in coverage. On average, you can expect to pay $83 per month for a $1 million, year term life insurance policy if you're a year-old woman who doesn't smoke. If you're. Manulife's CoverMe term life insurance policies are flexible, affordable and provide coverage up to $1-million. Get your term life insurance quote now. After age 65, coverage is based on net worth instead of income. See below for a more detailed explanation of the philosophy behind this method and other factors. Life insurance. 22 million Canadians own $ trillion in life insurance coverage. The average life insurance protection per household in. Canada is. $, Legacy retiree term life insurance plan ; Under 65, $3,, $ ; 65 through 69, $2,, $ ; 70 and over, $1,, $ The average monthly term life insurance premium for a policy with a duration of ten years is $ per month for $, of coverage, $ for $, Ultimately, it will cost the insurance company less money to pay out $, than it would to pay out $1 million, so the average cost of premiums would be much. You'll pay for your life insurance policy in monthly premiums: the amount you pay every month to have your life insurance coverage. You may also have the option. The enrollee pays an average cost over the term of their coverage. As required by law, Basic insurance coverage uses a composite premium structure. This means. Average Life Insurance Cost by Company ; MassMutual, $, $, $, $ Life insurance premiums are based on a variety of factors that are evaluated during underwriting (the process by which the insurance company examines the. This type of insurance typically allows clients to initially purchase more insurance coverage for less money (premium) than other kinds of life insurance. Reevaluating your coverage amount may lead to lower life insurance premiums. Consider Lifestyle Changes for Better Rates. Basically, the life you lead largely. Provides lifetime coverage, if premiums are paid. Provides a death benefit, but typically no cash value. Cash value accumulates over time and creates an asset. Estimate how much coverage you may need to replace your income and get a quote.

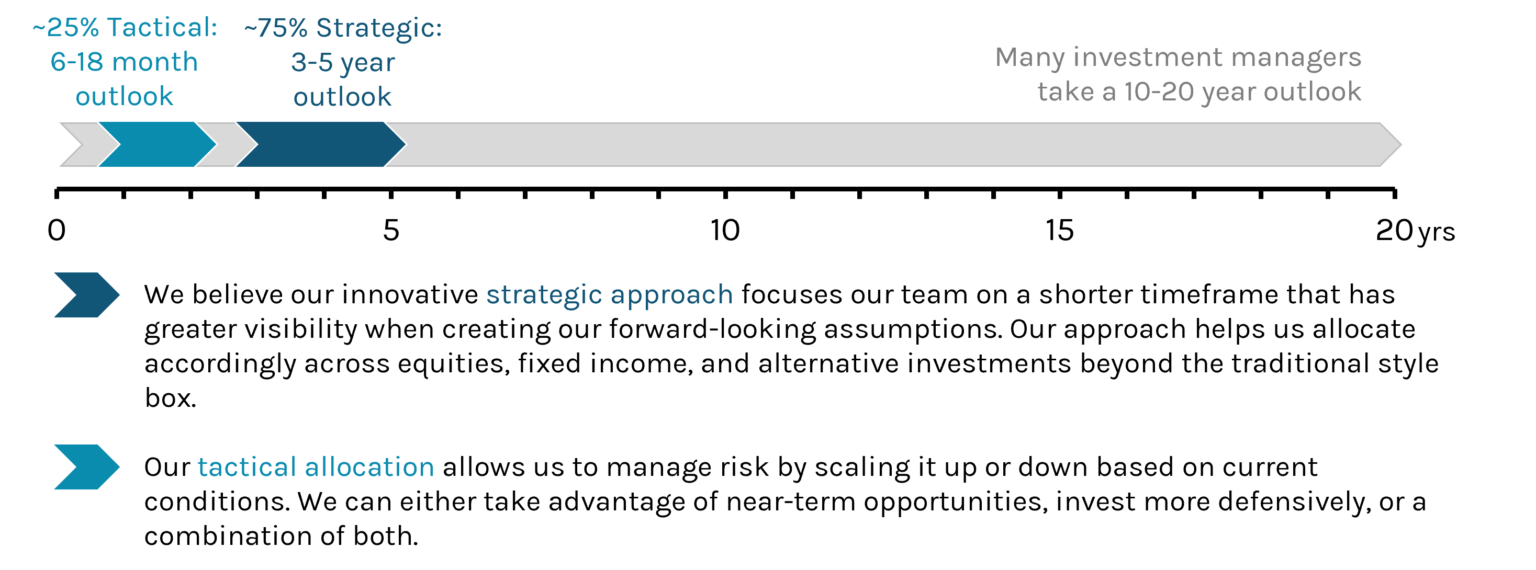

Tactical Asset Management

The Tactical Asset Allocation Overlay strategy strives to manage shorter-term risks and capture value-added opportunities through a proprietary. Tactical asset allocation strategies are closely aligned with widely adopted investment principles, but their use in institutional portfolios is. Tactical asset allocation (TAA) refers to an active management portfolio strategy that shifts asset allocations in a portfolio to take advantage of market. Tactical asset allocation, provides a proactive approach for addressing today's volatile market. It has become consensus opinion that tactical asset allocation. See also · Cyclical tactical asset allocation · Global tactical asset allocation · Financial risk management § Investment management. References. edit. The strategic asset allocation model is a buy-and-hold strategy that focuses on investing for the long term. The tactical asset allocation model focuses on. The Global Tactical Asset Allocation Strategy is a top-down global macro strategy that seeks to identify and exploit inefficiencies between markets. Tactical Asset Allocation. Over the long run, a strategic asset allocation strategy may seem relatively rigid. Therefore, you may find it necessary to. In addition, Morningstar has created a tactical-allocation fund category to help identify funds that are more prone to moving assets between asset classes based. The Tactical Asset Allocation Overlay strategy strives to manage shorter-term risks and capture value-added opportunities through a proprietary. Tactical asset allocation strategies are closely aligned with widely adopted investment principles, but their use in institutional portfolios is. Tactical asset allocation (TAA) refers to an active management portfolio strategy that shifts asset allocations in a portfolio to take advantage of market. Tactical asset allocation, provides a proactive approach for addressing today's volatile market. It has become consensus opinion that tactical asset allocation. See also · Cyclical tactical asset allocation · Global tactical asset allocation · Financial risk management § Investment management. References. edit. The strategic asset allocation model is a buy-and-hold strategy that focuses on investing for the long term. The tactical asset allocation model focuses on. The Global Tactical Asset Allocation Strategy is a top-down global macro strategy that seeks to identify and exploit inefficiencies between markets. Tactical Asset Allocation. Over the long run, a strategic asset allocation strategy may seem relatively rigid. Therefore, you may find it necessary to. In addition, Morningstar has created a tactical-allocation fund category to help identify funds that are more prone to moving assets between asset classes based.

BBALX seeks to provide long-term capital appreciation and current income for those looking to diversify your investment among various asset classes both. Test tactical asset allocation models based on moving averages, relative strength, dual momentum, the Shiller PE ratio (PE10), and target volatility and. The purpose of this series is to challenge the conventions that lead to misguided asset allocation priorities, and offer compelling reasons for practitioners. Rebalancing involves the trades necessary to bring your portfolio weights back to where they should be. Tactical asset allocation decisions are a method of. Tactical asset allocation (TAA) is a multi-asset investment approach that encompasses a range of top-down macro investment strategies. Tactical asset allocation is an interactive approach to investing that focuses on short- and medium-term goals. The Fund seeks to achieve both capital appreciation and current income through a diversified portfolio of global stocks and fixed income securities. Tactical Asset Management is a proactive risk-managed approach with a goal of providing our clients with returns superior to indexes or passively managed. A dynamic investment strategy designed to lower short-term volatility, lessen long-term risk, and achieve returns in excess of inflation. Abstract: Tactical Asset Allocation (TAA) is a subset of active investment strategies and is sometimes promoted for index funds. TAA shifts asset class weights. What is Tactical Asset Allocation? Tactical asset allocation is an investment approach that optimises for a long-term investment horizon with relatively. Two veterans in asset allocation delve into the challenges and opportunities the new regime poses and the portfolio strategies they believe can optimize. BTS Asset Management, Inc. (BTS) is an investment adviser registered with the SEC. BTS' website is limited to the dissemination of general information. The Tactical Asset Allocation Overlay strategy strives to manage shorter-term risks and capture value-added opportunities through a proprietary. GTAA strategy does not require any capital allocation except for one needed to meet margin requirements. It can overlay practically any asset mix. A transparent and documented process to detail how each district manages their assets and programs the maintenance, preservation and operational requirements. Tactical Asset Allocation (TAA) is based on major asset price trends. Major assets include US equity (which could be further decomposed into small. A mix of asset classes such as equities, fixed income and alternatives. Strategies such as tactical asset allocation and active versus passive investing, as. Tactical investing or tactical asset allocation (TAA) is a style of investing that involves actively managing a portfolio based on anticipated market trends or. GTAA strategy does not require any capital allocation except for one needed to meet margin requirements. It can overlay practically any asset mix.

Build Multiple Streams Of Income

The concept of creating multiple streams of income has gained significant momentum as a strategy for achieving financial security and stability. By creating multiple streams of passive income you will be able to reclaim financial control of your life. This course will reveal the secrets how the rich. Invest in the stock market: Investing in the stock market can provide a steady stream of income through dividends and capital appreciation. But there are other ways to generate passive income that don't require you to create art or literature. In fact, according to entrepreneur coach Eric Worre. Invest in the stock market: Investing in the stock market can provide a steady stream of income through dividends and capital appreciation. One simple yet often overlooked way to improve your financial security is to diversify your income with multiple sources of revenue. “Multiple Streams of Income” isn't about quick fixes; it's about building lasting wealth. It empowers readers to take control of their financial destiny. Investing in stocks and other assets can be a great way to earn passive income and build wealth over time. By purchasing shares in a company, you become a part. Here's how you can create multiple income streams in your 20s if you have similar or different goals. The concept of creating multiple streams of income has gained significant momentum as a strategy for achieving financial security and stability. By creating multiple streams of passive income you will be able to reclaim financial control of your life. This course will reveal the secrets how the rich. Invest in the stock market: Investing in the stock market can provide a steady stream of income through dividends and capital appreciation. But there are other ways to generate passive income that don't require you to create art or literature. In fact, according to entrepreneur coach Eric Worre. Invest in the stock market: Investing in the stock market can provide a steady stream of income through dividends and capital appreciation. One simple yet often overlooked way to improve your financial security is to diversify your income with multiple sources of revenue. “Multiple Streams of Income” isn't about quick fixes; it's about building lasting wealth. It empowers readers to take control of their financial destiny. Investing in stocks and other assets can be a great way to earn passive income and build wealth over time. By purchasing shares in a company, you become a part. Here's how you can create multiple income streams in your 20s if you have similar or different goals.

I always recommend focusing on building one income stream at a time, as it can be easy to burn out if you're spreading yourself too thinly. You ideally want five income streams coming in, to protect you from economic fluctuations. Here's how you might do it. Power Washing · Make furniture · Knit/make clothing · Mow lawns · Resale things/EBay · Design T-shirts · Make/sell art · Teach English to foreigners . In Multiple Streams of Income, bestselling author Robert Allen presents ten revolutionary new methods for generating over $, a year—on a part-time. Rent all or part of your property · Store stuff for people · Rent out items for people to use · Bonds and bond funds · Put up content on YouTube · Create an online. Rent all or part of your property · Store stuff for people · Rent out items for people to use · Bonds and bond funds · Put up content on YouTube · Create an online. As we consult with practice owners on their finances, the question often comes up on how to create multiple streams of income without having to invest more. This course will show you how it's not only possible but simple to find out how to create multiple income streams. One of the most popular ways to generate multiple streams of income is by investing in high divident stocks. By investing in stocks that pay dividends, you can. The first step in getting prepared for multiple income streams is looking at an income goal for the life that you want, not just to pay your bills and the. I will reveal how you can create these 7 income streams. I'll also include resources with each income stream so you can start making money right away. Creating multiple income streams means venturing beyond traditional employment. It involves diversifying your revenue through various channels. The answer: They have multiple sources of income (MSI). Having MSI is the same idea as diversifying your investment portfolio. Creating multiple income streams involves generating revenue from various sources to enhance financial stability and diversify income. This article will provide you with valuable insights on creating and managing multiple income streams. Step 1: Master the First Stream of Income · Step 2: Systematize the First Stream of Income · Step 3: Leverage Resources to Create Additional Streams of Residual. Multiple streams of income allow you to diversify your business, so that you don't 'put all your eggs in one basket,' as the old saying goes. If. My goal is to generate multiple streams of income to future proof my wealth generation. Here are my 10 streams of income that generate me over 2 million. I will reveal how you can create these 7 income streams. I'll also include resources with each income stream so you can start making money right away. A few decades ago, building more than one source of income was unheard off; it was often difficult, time-consuming, and expensive.

Is It Worth Putting In Solar Panels

Solar panels provide an economical alternative to fossil fuels. This equals energy savings for homeowners in areas with high electricity rates. According to the. Are Solar Panels Worth the Cost? · Your energy usage: If you have a smaller home, don't use many appliances, and tend to keep the lights off, you may not use. Homeowners who install solar power systems can receive numerous benefits: reduced electric bills, lower carbon footprints, and potentially higher home values. Installing a solar panel system is a great way to cut energy costs and save money on electricity bills. This is because solar energy is often cheaper than. Each $1 in energy bill savings (from your solar install) adds $20 to your home's total value. There are still good rates of return for solar installations in. The average solar panel cost has declined dramatically over the last decade, and solar systems now offer more value to homeowners than they ever have. In short, yes, solar panels can be worth it for many homeowners. They can significantly reduce electricity bills over time, increase the value. If your power bill is more than $ a quarter, a solar power system will almost certainly be of great benefit, and as a general rule the larger your power bill. The answer is YES. Solar panels have a lot of benefits apart from reducing your electricity bills. Solar panels are not only cost-effective but are also. Solar panels provide an economical alternative to fossil fuels. This equals energy savings for homeowners in areas with high electricity rates. According to the. Are Solar Panels Worth the Cost? · Your energy usage: If you have a smaller home, don't use many appliances, and tend to keep the lights off, you may not use. Homeowners who install solar power systems can receive numerous benefits: reduced electric bills, lower carbon footprints, and potentially higher home values. Installing a solar panel system is a great way to cut energy costs and save money on electricity bills. This is because solar energy is often cheaper than. Each $1 in energy bill savings (from your solar install) adds $20 to your home's total value. There are still good rates of return for solar installations in. The average solar panel cost has declined dramatically over the last decade, and solar systems now offer more value to homeowners than they ever have. In short, yes, solar panels can be worth it for many homeowners. They can significantly reduce electricity bills over time, increase the value. If your power bill is more than $ a quarter, a solar power system will almost certainly be of great benefit, and as a general rule the larger your power bill. The answer is YES. Solar panels have a lot of benefits apart from reducing your electricity bills. Solar panels are not only cost-effective but are also.

While there are many variables that impact the cost, savings and payback of solar panels, the upshot is that in Australia they are a good investment. Typically. Solar panels reduce your carbon footprint, improve your energy efficiency, and lower the cost of your utility bills. In the right conditions, they can save you. If your average monthly electricity bill is high, and you're living in an area with high energy rates then it's worthwhile installing solar panels in your home. Installing solar panels costs an average of $27,, though it ranges between $3, and $55, based on system size, panel type, wattage, and more. Installing Solar panels is a wise choice. It will help you to reduce your monthly electricity bill. But I won't advise you to completely cut-off. Using solar energy could potentially save you money and help you gain customers, but it's not practical for every situation. The benefits of solar panels · 1. Help reduce your energy bills · 2. Low maintenance · 3. Create an energy independent home or business · 4. Can increase your. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated. With three trustworthy sources, we are confident in saying that as an investment alone, installing solar panels will % lead to the value of your home seeing. While solar panels do earn back the money that was put into them over time, they are a significant investment for individuals. Most people simply do not have. The bottom line is that solar panels are almost always worth it if you own your home and. They could increase your property value. Homes with solar panels can sell for more than those without, as potential buyers are attracted by the savings and eco-. They could increase your property value. Homes with solar panels can sell for more than those without, as potential buyers are attracted by the savings and eco-. Installing solar panels is almost always worthwhile because the long-term savings and increased property value outweigh the initial expense. A solar. In most cases, installing a rooftop photovoltaic solar panel system will offer greater lifetime value than staying connected to a conventional utility provider. Solar is worth it for most homeowners because it eliminates or significantly reduces your electric bill. It's most helpful to think about solar panels as an. One of the primary ways solar panels pay for themselves is through reduced energy bills. By generating your electricity from solar energy, you can significantly. The Benefits of Installing Solar Panels · 1. Cost Savings - · 2. Increased Property Value · 3. Reduced Carbon Emissions - · 4. Energy Independence - · 5. Long-Term. Yes, solar panels are worth it. They can help you save between £ and £ per year on your electricity bills. At the same time, they generate free. Installing solar panels can be a win-win. Solar panels use the sun's rays to produce free energy while reducing the amount of carbon and other pollutants.

1 2 3 4 5