imprimermonlivre.ru Market

Market

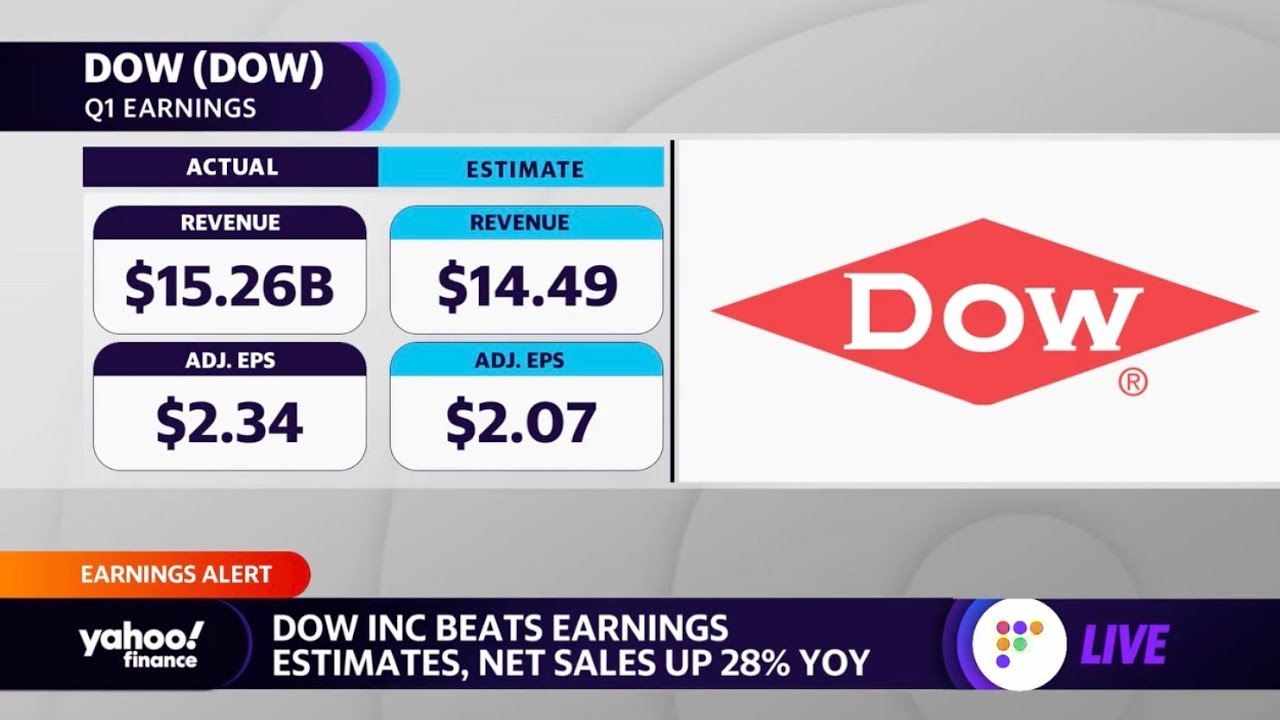

Dowinc Stock

Stock Quote. NYSE: DOW. Price. Volume. 4. Change. % Change. %. Today's View historical dividend information prior to Dow Inc., April 1. Dow Inc (DOW) has a Smart Score of 3 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Latest Dow Inc (DOW:NYQ) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and more. Stay up-to-date on Dow Inc. Common Stock (DOW) news with the latest updates, breaking headlines, news articles, and more from around the web at imprimermonlivre.ru Dow, Inc. is a materials science company, which engages in the development of innovative solutions. It operates through the following segments. Dow Inc. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Get the latest Dow Inc (DOW) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Stock analysis for Dow Inc (DOW:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Stock Quote. NYSE: DOW. Price. Volume. 4. Change. % Change. %. Today's View historical dividend information prior to Dow Inc., April 1. Dow Inc (DOW) has a Smart Score of 3 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Latest Dow Inc (DOW:NYQ) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and more. Stay up-to-date on Dow Inc. Common Stock (DOW) news with the latest updates, breaking headlines, news articles, and more from around the web at imprimermonlivre.ru Dow, Inc. is a materials science company, which engages in the development of innovative solutions. It operates through the following segments. Dow Inc. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Get the latest Dow Inc (DOW) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Stock analysis for Dow Inc (DOW:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

End of Day Stock Quote. Investor Events & Presentations. Press Releases. Quarterly Reports. SEC Filings. Seek Together Blog. Unsubscribe. Email Alert Sign Up. Dow Inc. · Analyst Ratings · StockGrader · Analyst Ratings · Stock Price Target · Yearly Estimates · Quarterly Actuals · Quarterly Estimates · FY Estimate Trends. Stay up-to-date on Dow Inc. Common Stock (DOW) news with the latest updates, breaking headlines, news articles, and more from around the web at imprimermonlivre.ru Dow Inc (DOW) has a Smart Score of 3 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. Discover real-time Dow Inc. Common Stock (DOW) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Dow Inc (DOW) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Dow Inc. (imprimermonlivre.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Dow Inc. | Nyse: DOW | Nyse. See the latest Dow Inc stock price (DOW:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Dow Inc Share Price Live Today:Get the Live stock price of DOW Inc., and quote, performance, latest news to help you with stock trading and investing. View Dow, Inc. DOW stock quote prices, financial information, real-time forecasts, and company news from CNN. What Is the Dow Inc Stock Price Today? The Dow Inc stock price today is What Is the Stock Symbol for Dow Inc? The stock ticker symbol for Dow Inc is DOW. View live Dow Inc. chart to track its stock's price action. Find market predictions, DOW financials and market news. Largest shareholders include Vanguard Group Inc, BlackRock Inc., State Street Corp, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Jpmorgan. Dow Inc. serves as a holding company for The Dow Chemical Company and its subsidiaries. The Company conducts its operations through six global businesses. How to buy Dow Inc stock on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in Dow. Get Dow Inc (DOW:NYSE) real-time stock quotes, news, price and financial information from CNBC. Analyst Forecast. According to 14 analysts, the average rating for DOW stock is "Hold." The month stock price forecast is $, which is an increase of. See charts, data and financials for Dow Inc DOW. In both cases, DowDuPont stockholders received or will receive cash in lieu of any fractional shares of the common stock of Dow Inc. or Corteva, Inc. Was. Dow Inc. (DOW) closed at $ in the latest trading session, marking a % move from the prior day.

What Does Annual Fee Mean For A Credit Card

80 votes, comments. Just curious to know how much people in this sub pay yearly in credit card annual fees. Everyday purchases you make can earn you cashback with your Tangerine Money-Back Credit Card. There's also no annual fee. Learn more. This is like a membership fee that you pay once a year to your credit card company for using their card. Not all credit cards have an annual fee. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees. TD Aeroplan Visa Credit Cards. Annual Fee. TD® Aeroplan®Visa Platinum* Card ›. Annual Fee $ Additional Card Holders: $ The annual percentage rate (APR) is the cost of borrowing on a credit card. It refers to the yearly interest rate you'll pay if you carry a balance, plus any. Annual fees is essentially buying perks and prepaying for credits. You should only consider paying for an annual fee card if you get more value. The average credit card annual fee is about $, but many cards have no annual fee. A credit card's annual fee typically is charged on the account. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ 80 votes, comments. Just curious to know how much people in this sub pay yearly in credit card annual fees. Everyday purchases you make can earn you cashback with your Tangerine Money-Back Credit Card. There's also no annual fee. Learn more. This is like a membership fee that you pay once a year to your credit card company for using their card. Not all credit cards have an annual fee. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees. TD Aeroplan Visa Credit Cards. Annual Fee. TD® Aeroplan®Visa Platinum* Card ›. Annual Fee $ Additional Card Holders: $ The annual percentage rate (APR) is the cost of borrowing on a credit card. It refers to the yearly interest rate you'll pay if you carry a balance, plus any. Annual fees is essentially buying perks and prepaying for credits. You should only consider paying for an annual fee card if you get more value. The average credit card annual fee is about $, but many cards have no annual fee. A credit card's annual fee typically is charged on the account. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $

Credit card annual fees help offset the cost of providing lucrative rewards to cardholders, whether it's cash back, points, travel miles, or other perks. The annual fee on a credit card is the fee charged by the card issuer to extend the credit card to you. Some cards don't charge an annual fee, but others—most. No annual fee credit cards · Citi Rewards+® Card · Citi Rewards+® Card · Intro purchase APR · Regular purchase APR · Annual fee · Capital One Quicksilver Cash Rewards. No annual fee. Rewards without an annual credit-card fee means more money for the things you love Hi, card is fine as a credit card, however after my. The amount of the fee varies by issuer and by credit card. Annual fees on credit cards can range from very low to hundreds of dollars. A credit card's APR (annual percentage rate) is the total cost of its interest rate (eg 20%) plus the fees every cardholder pays as standard, such as the. No fee credit cards that offer great rewards discounts, cash back and privileges. Why pay more than you have to? Credit cards with no annual fee offer the flexibility of credit without the cost of a yearly fee. Apply online. Annual Membership Fee means an annual membership fee or similar fee that is charged to an Account under the related Credit Card Agreement. Annual fee is the amount you pay to the card issuer which is a part of the service charge annually. For most of the credit cards the fee is. An annual (yearly) fee charged by a credit card company each year for use of a credit card. This is a separate fee from interest rate on purchases. However, for the majority, the average credit card annual fee ranges from roughly $ to $ credit card imprimermonlivre.ru Compare the best credit cards on. Yes, Credit cards with annual fees are good because they act as reserve plastic money in the situations when you run out of cash, or you are. What does no annual fee on credit cards mean? No annual fee credit cards are cards that don't require you to pay a yearly fee to use them. Annual fees are. Roughly two-thirds of cards, or 68 percent, don't charge an annual fee, but of the ones that do, the average annual fee is almost $ The annual percentage rate (APR) is the cost of borrowing on a credit card. It refers to the yearly interest rate you'll pay if you carry a balance, plus any. Some lenders charge a yearly fee to use a card. Cards with annual fees often have more benefits than cards that don't. Fees can range anywhere from $50 to over. No Annual Fee Credit Card that lets you earn unlimited cash back credits All supplementary cards are offered at no annual fees for Desjardins members. Your annual credit card fee works like a subscription fee, meaning it's the rate you pay to continue enjoying your credit card's facilities, services, and. The APR, or annual percentage rate, is the standard way to compare how much loans cost. It lets you compare the cost of loan products on an “apples-to-apples”.

Dave Ramsey The Total Money Makeover Amazon

imprimermonlivre.ru: The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace (Audible Audio Edition): Dave Ramsey, Dave Ramsey. $!) It's no secret that we're big Dave Ramsey fans in our home, so I'm excited to share this deal. Right now on Amazon, you ca snag the Total Money. Ramsey offers a bold, no-nonsense approach to money matters, providing not only the how-to but also a grounded and uplifting hope for getting out of debt. The Top 7 Finance Books Money Q&A Readers Are Buying on Amazon. by Hank The Total Money Makeover: A Proven Plan for Financial by Dave Ramsey is a. The Total Money Makeover by Dave Ramsey Hardcover Book Dust Jacket Debt Snowball ; Quantity. 1 available ; Item Number. ; Features. Dust Jacket. All Books · Image of The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness · Image of Baby Steps Millionaires: How Ordinary People Built. A simple, straight-forward game plan for completely making over your money habits! Best-selling author and radio host Dave Ramsey is your personal coach. Dave's eight national bestselling books include The Total Money Makeover, Baby Steps Millionaires, and EntreLeadership. He has appeared on Good Morning America. It's the simplest, most straightforward game plan for completely making over your money habits. And it's based on results, not pie-in-the-sky fantasies. imprimermonlivre.ru: The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace (Audible Audio Edition): Dave Ramsey, Dave Ramsey. $!) It's no secret that we're big Dave Ramsey fans in our home, so I'm excited to share this deal. Right now on Amazon, you ca snag the Total Money. Ramsey offers a bold, no-nonsense approach to money matters, providing not only the how-to but also a grounded and uplifting hope for getting out of debt. The Top 7 Finance Books Money Q&A Readers Are Buying on Amazon. by Hank The Total Money Makeover: A Proven Plan for Financial by Dave Ramsey is a. The Total Money Makeover by Dave Ramsey Hardcover Book Dust Jacket Debt Snowball ; Quantity. 1 available ; Item Number. ; Features. Dust Jacket. All Books · Image of The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness · Image of Baby Steps Millionaires: How Ordinary People Built. A simple, straight-forward game plan for completely making over your money habits! Best-selling author and radio host Dave Ramsey is your personal coach. Dave's eight national bestselling books include The Total Money Makeover, Baby Steps Millionaires, and EntreLeadership. He has appeared on Good Morning America. It's the simplest, most straightforward game plan for completely making over your money habits. And it's based on results, not pie-in-the-sky fantasies.

I saw two editions of Dave Ramsay's book on Amazon. The classic and the 3rd edition. Does anyone know the difference and if the version. The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness: Ramsey, Dave: imprimermonlivre.ru: Books. Refine By ; Financial Peace University. $ ; New! The Total Money Makeover – Updated and Expanded Edition. $ ; Baby Steps Millionaires. $ A simple, straight-forward game plan for completely making over your money habits! Best-selling author and radio host Dave Ramsey is your personal coach in. The Total Money Makeover is the simplest, most straightforward game plan for completely changing your finances. “The Total Money Makeover” by Dave Ramsey is quite popular among those interested in personal finance and debt management. It offers a step-by-. By Dave Ramsey - The Total Money Makeover: A Proven Plan for Financial Fitness [Dave Ramsey] on imprimermonlivre.ru *FREE* shipping on qualifying offers. Amazon Digital and Device Forum United States. Hi there- I purchased a kindle ebook by Dave Ramsey an August of called The Total Money Makeover. The Total Money Makeover by Dave Ramsey is a step-by-step guide aimed at helping individuals overhaul their financial situation through debt elimination. If you will live like no one else, later you can "live" like no one imprimermonlivre.ru up your money muscles with America's favorite finance coach. The Total Money Makeover Workbook [paperback] [Dave Ramsey] on imprimermonlivre.ru *FREE* shipping on qualifying offers. The Total Money Makeover Set: The Total. The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace. by Dave Ramsey · out of 5 stars. (21,). Hardcover. $$ Ramsey, Dave: Books - Amazon the money answer book quick answers for your everyday financial questions by david ramsay, author. Date read: How strongly I recommend it: 9/ The Total Money Makeover: A Proven Plan for Financial Fitness by Dave Ramsey on Amazon. The Total Money Makeover 3th (third) edition Text Only [Dave Ramsey] on imprimermonlivre.ru *FREE* shipping on qualifying offers. The Total Money Makeover 3th. “The Total Money Makeover” by Dave Ramsey is quite popular among those interested in personal finance and debt management. It offers a step-by-. Author: Dave Ramsey Tag: Other Publisher: Thomas Nelson Publication Year Click to buy anything on Amazon to support TOB! img Copyright © The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace © , imprimermonlivre.ru, Inc. or its affiliates. Close menu. Sign in. But here are the top 10 books to check out if you're interested in Ramsey's philosophy. The Total Money Makeover. total money. Buy it on Amazon.

Should You Roll Over Your 401k To New Employer

Should I Roll Over My (k) to My New Employer's Plan? Rolling over your (k) to a new employer's plan is the easiest option. If you really like the new. Three of the options – leaving your money in the plan, moving it to your new employer's plan and rolling over to an IRA – will allow you to continue to earn. Not all employers will accept a rollover from a previous employer's plan, so check with your new employer before making any decisions. Some benefits: Your money. Yes. You can roll over almost any type of employer-sponsored retirement plan, such as a (k), (b), or into a Vanguard IRA. You can roll over funds from a (a) into a qualified (a) plan with another employer, (if the employer allows rollovers), as well as into a traditional IRA. If your former employer allows, keep your money where it is. You'll continue your tax-deferred growth potential but can't contribute anymore. Investment. If your new employer offers a (k), you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount. 1. Leaving money in your current plan · 2. Rolling over into a new employer plan · 3. Consolidating multiple accounts with a rollover IRA · 4. Withdrawing your. Rolling over your old (k) into your new company's plan can also make it easier to track your retirement savings, since you'll have everything in one place. Should I Roll Over My (k) to My New Employer's Plan? Rolling over your (k) to a new employer's plan is the easiest option. If you really like the new. Three of the options – leaving your money in the plan, moving it to your new employer's plan and rolling over to an IRA – will allow you to continue to earn. Not all employers will accept a rollover from a previous employer's plan, so check with your new employer before making any decisions. Some benefits: Your money. Yes. You can roll over almost any type of employer-sponsored retirement plan, such as a (k), (b), or into a Vanguard IRA. You can roll over funds from a (a) into a qualified (a) plan with another employer, (if the employer allows rollovers), as well as into a traditional IRA. If your former employer allows, keep your money where it is. You'll continue your tax-deferred growth potential but can't contribute anymore. Investment. If your new employer offers a (k), you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount. 1. Leaving money in your current plan · 2. Rolling over into a new employer plan · 3. Consolidating multiple accounts with a rollover IRA · 4. Withdrawing your. Rolling over your old (k) into your new company's plan can also make it easier to track your retirement savings, since you'll have everything in one place.

You should roll it. There's really no advantage to keeping it at your former employer. Inside their k you can only invest in their funds and. Having one less extraneous retirement account to keep an eye on helps give you peace of mind knowing that your retirement savings are held in one place. Since. Rolling over your (k) to a new employer helps you avoid retirement plan sprawl. Rolling over your (k), whether into an IRA or your new company plan, may. First, consider moving your old k into an IRA. You will have the same tax advantages but will have far more options on how to invest. If the funds offered in the new plan are better than those offered in the old plan, it would make sense to roll the old into the new. If the. If you're a conservative investor and your plan offers an attractive stable value or fixed account offering, it could make sense to continue using your (k). Rolling your funds over into a new account should be easy and comes with tax advantages. But keep in mind, you'll only have 60 days to deposit the check into. If you're starting a new job, moving your retirement savings to your new employer's plan could be an option. A new (k) plan may offer benefits similar to. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. You don't have to roll over your (k), but when you leave your money with your former employer's plan, your investment choices are limited to what's available. Consider all the factors involved when deciding what to do with your (k) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum. Generally, you have 4 options for what to do with your savings: keep it with your previous employer, roll it into an IRA, roll it into a new employer's plan, or. Roll over the assets to the new employer's plan if one exists and rollovers are permitted; Roll over to an IRA; Cash out the account value. But, can you a roll. If your former employer allows, keep your money where it is. You'll continue your tax-deferred growth potential but can't contribute anymore. Investment. You'll need to check with your plan administrator at your new employer to see if this is an option. Some plans are lenient about accepting rollovers, while. The pros of rolling over (k) to a new employer's (k) include ease of management, employer's match, tax savings, and early retirement options. Once you leave your company, you may be eligible to rollover your Guideline (k) funds into your new employer's plan. Roll Over the Money into an IRA. A rollover IRA is an IRA that allows you to transfer funds from your former employer-sponsored retirement plan into the account. If your defined benefit plan offers the proper type of distribution, you could roll it over to an IRA or to a new employer's plan, if the plan allows. You. When you roll over a retirement plan distribution, you generally don't pay tax on it until you withdraw it from the new plan. By rolling over, you're saving for.

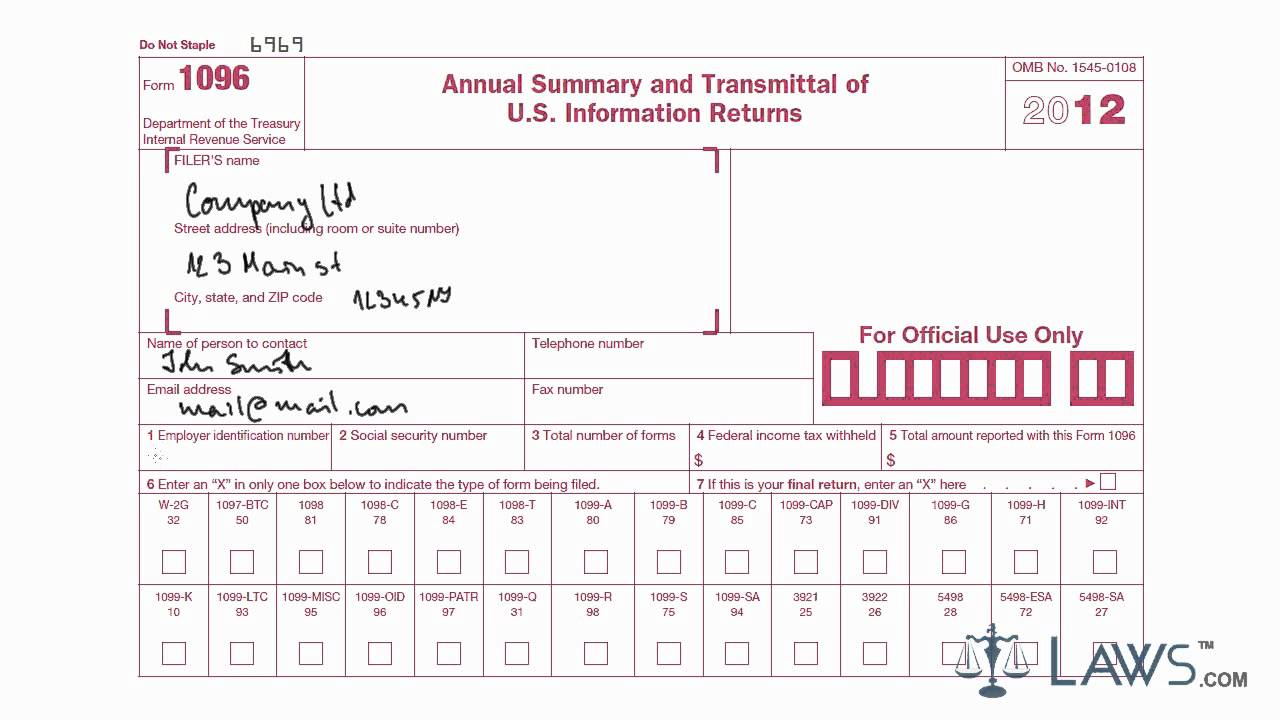

Filling Out Form 1096

Form is an Internal Revenue Service tax form used in the United States used to summarize information returns being sent to the IRS. However, when e-filing these forms with BoomTax, there is no need to fill out Form For your records, Form will be auto-generated in your account. How to Fill Out a Form? · Business Name: Write the legal name of your business as registered. · Address: Provide the complete address of your business. Currently, Form cannot be filed online. The IRS requires a physical copy for their records. Prepare your form accurately. Fill Form. IRS Form is officially named the "Annual Summary and Transmittal of U.S. Information Returns" by the IRS. It's used to summarize details about other. Do not cut or separate forms that are two or three to a page. Submit the entire page even if only one of the forms on the page is completed. · Do not staple the. 3. Fill out the boxes Tax form includes six boxes that summarize information about the documents you'll be submitting. Box One. If you have an employer. Form is also titled "Annual Summary and Transmittal of U.S. Information Returns". If your business has made out any one of the following forms to any. IRS Form essentially acts like a fax cover sheet. It is sent with your completed return forms to inform the IRS precisely what you're submitting. Form is an Internal Revenue Service tax form used in the United States used to summarize information returns being sent to the IRS. However, when e-filing these forms with BoomTax, there is no need to fill out Form For your records, Form will be auto-generated in your account. How to Fill Out a Form? · Business Name: Write the legal name of your business as registered. · Address: Provide the complete address of your business. Currently, Form cannot be filed online. The IRS requires a physical copy for their records. Prepare your form accurately. Fill Form. IRS Form is officially named the "Annual Summary and Transmittal of U.S. Information Returns" by the IRS. It's used to summarize details about other. Do not cut or separate forms that are two or three to a page. Submit the entire page even if only one of the forms on the page is completed. · Do not staple the. 3. Fill out the boxes Tax form includes six boxes that summarize information about the documents you'll be submitting. Box One. If you have an employer. Form is also titled "Annual Summary and Transmittal of U.S. Information Returns". If your business has made out any one of the following forms to any. IRS Form essentially acts like a fax cover sheet. It is sent with your completed return forms to inform the IRS precisely what you're submitting.

Yes, Form can be filed electronically through authorized e-filing platforms for more efficient and accurate processing. What if I made a mistake on Form. Form is the Annual Summary and Transmittal of US Information Returns. You must submit one of these summary transmittals with Copy A forms. Once you have a paper copy of Form , it's time to fill it out. After filling out your business' contact information in the top of the form (including. Cover sheets Form W-3 and Form are only needed when filing paper copies of W-2s or s. Since Gusto files your forms electronically, we're not required. A business submitting multiple tax forms to report non-employee compensation must also send an accompanying Form They must file Form if they submit. We take care of printing and mailing the forms to your recipients, as well as e-filing your forms directly with the IRS or SSA. Skip filling out Form or W-. Locate the W-2s/CT-W3 Annual Reconciliation of Withholding or s/CT Annual Summary of Withholding hyperlink and continue your filing. As a Single. Currently, Form cannot be filed online. The IRS requires a physical copy for their records. Prepare your form accurately. Fill Form. The Tax Form, also known as the "Annual Summary and Transmittal of US Information Returns," acts as a cover sheet for paper forms of certain information. Check the box at the top of the form to indicate the filing is a Corrected form. Fill out and include Form to indicate how many of which type of form you'. Filing Form is mandatory when a business has paid $ or more to a freelancer or independent contractor during the calendar year. Employees and. Gain clarity on IRS Form , including step-by-step filing instructions, the consequences of filling it out incorrectly, and recommendations for. After you have filled out all of your forms for the year, you need to fill out a Form as well. Form summarizes all of your forms and is. To reprint previously completed 10forms, follow the steps below on the workstation you originally processed s. Form is used summarize all information that is physically mailed to IRS. E-file through ExpressTaxFilings, a is not required by the IRS. Form is a tax form filed on behalf of businesses with the United States Internal Revenue Service (IRS) to accompany forms filed to report non-employee. Only the additional forms need to be created and e-filed. When DAS creates the //W-2G electronic upload file, the information included totals. Form summarizes information returns such as tax forms , , , , , , and W-2G. It includes essential information like the number of. How to Fill Out a Form? · Identification: Business Name: Write the legal name of your business as registered. · Form Details: Type of Form: On the Form. IRS Form is an annual summary and transmittal form used to submit paper copies of information returns, such as Forms , , , and W-2G, to the IRS.

Best Return On Investment Short Term

Safe investment options like fixed deposits are good short-term investment options that provide you with flexibility and safety of deposit to earn assured. STUBBORNLY HIGH INTEREST RATES have given renewed luster to cash as an investment. Short-term interest rates can change dramatically and quickly, and if you. Consider a high yield savings account (HYSA) for your $k. It's safe and earns around % interest. Good option to grow your money. Good for short-term needs. A savings account is the ideal spot for an interest rate and better loan terms. If you're planning to make one of these. Invest in top cryptocurrencies all over the world. See the top gainers Short Duration Fund: These mutual funds select bonds/debt for investment. The interest rate you pay on the vast majority of short-term debt is likely to be many times higher than the rate of return on any investment you make. You. High-Yield Savings Accounts One of the safest and easiest short-term investment options is a high-yield savings account. They work the same as a standard. Money market funds are a type of fund that invest in short-term debt securities such as Treasury bills and certificates of deposit, known as CDs. These funds. Best Short Term Investment Options in India: · 1. Fixed Deposits · 2. Savings Accounts · 3. Recurring Deposits · 4. Money Market Funds · 5. Treasury Bills. Safe investment options like fixed deposits are good short-term investment options that provide you with flexibility and safety of deposit to earn assured. STUBBORNLY HIGH INTEREST RATES have given renewed luster to cash as an investment. Short-term interest rates can change dramatically and quickly, and if you. Consider a high yield savings account (HYSA) for your $k. It's safe and earns around % interest. Good option to grow your money. Good for short-term needs. A savings account is the ideal spot for an interest rate and better loan terms. If you're planning to make one of these. Invest in top cryptocurrencies all over the world. See the top gainers Short Duration Fund: These mutual funds select bonds/debt for investment. The interest rate you pay on the vast majority of short-term debt is likely to be many times higher than the rate of return on any investment you make. You. High-Yield Savings Accounts One of the safest and easiest short-term investment options is a high-yield savings account. They work the same as a standard. Money market funds are a type of fund that invest in short-term debt securities such as Treasury bills and certificates of deposit, known as CDs. These funds. Best Short Term Investment Options in India: · 1. Fixed Deposits · 2. Savings Accounts · 3. Recurring Deposits · 4. Money Market Funds · 5. Treasury Bills.

What is the Tenure of Short-Term Investment Plans? · Savings Accounts: Offer immediate liquidity, making them suitable for very short-term needs. · Fixed. On the other hand, investing solely in cash investments may be appropriate for short-term financial goals. better investment returns in another asset category. Top NRI Plans · Bank Fixed Deposit (FD). It is one of the safest one-time investment plans wherein you can invest your money for short-term like for one. Short-term CDs (Certificates of Deposit) · Short-term Treasuries · Short-term investment-grade municipal or corporate bonds · Short-term bond funds. Short-term investments like Treasury bills, high-yield savings accounts, short-dated CDs, money market accounts, and government bonds offer some of the best. Top schemes of Short Duration Mutual Funds sorted by Returns ; Bank of India Short Term Income Fund. #14 of 20 · Fund Size. ₹72 Crs · + % ; Sundaram Short. One such fund is the Vanguard Short-Term Tax-Exempt Fund Investor Shares (VWSTX). The fund invests in high-quality, short-term municipal securities with an. Learn how investing in bonds can help offset inflation and complement your long-term portfolio. high-yield environment. Article. Bonds. Load More. Showing. long-term sustainable financial return in a fast changing world. It Top 10 long and short positions - The top 10 holdings ranked by market value in. Post-office time deposits, also known as post office fixed deposits, are one of the safest and best short-term investment plans that offer assured returns to. Best Short-Term Investments · 1. High-Yield Savings Accounts · 2. Money Market Accounts (MMAs) · 3. Certificates of Deposit (CDs) · 4. Treasury Bills (T-Bills) · 5. These funds offer a low level of risk because they invest in low-risk investments like government-backed securities. You can use a money market fund to save for. Learn about a variety of short-term investments that can provide a consistent source of income, including online savings accounts, short-term bond funds. What to invest in right now · 2. Exchange-traded funds (ETFs). If you're worried about researching and selecting individual stocks, an alternative is to invest . High-yield, lower-rated, securities involve greater risk than higher-rated Investment return, price, yield and Net Asset Value (NAV) will fluctuate. Money market funds are mutual funds that invest in short-term, low-risk assets like Treasury and government securities, commercial paper, or municipal debt—. Defensive investments ; Investment. Characteristics. Risk, return and investing time frame ; Cash. Includes bank accounts, high interest savings accounts and term. Some aspects to consider are their low returns, high liquidity, and low risk. There is a wide variety of ways to invest in short-term assets. Among many. Savings and Money Market Accounts These are the most common types of short-term investment plans. Depositing money into these accounts earns interest over.

Best Home Air Conditioning System

Efficiency ratings and brand choice can significantly affect the total cost. Additional costs may include ductwork, removal of old systems and permits. Fujitsu. Indoor unit: ASYG07KGTE. Outdoor unit: AOYG07KGCA. Cooling capacity (kW). 2,0. Heating capacity (kW). 2,5. Efficiency (cooling). A+++. Carrier and Trane are probably the most reliable when installed properly. They are built more solid, literally. Since , Trane has led the HVAC industry in developing and manufacturing sustainable HVAC systems that increase your home comfort while lowering your energy. In this article, we walk you through the pros and cons of each of the units and systems to help you decide on the best option for your home. Each has its own specialized uses, but they all essentially do the same thing – make it cool inside your home. The type of cooling system that works best for. American Standard is the best overall HVAC company on this year's list, but all of the brands featured here offer reliable equipment – some at an affordable. ENERGY STAR certified air conditioners have higher seasonal energy efficiency ratio (SEER) and energy efficiency ratio (EER) ratings. A central air conditioner. Every one of these air conditioning brands is an excellent choice for your home. Lennox, Trane, or Amana are the brands to consider if you want the most. Efficiency ratings and brand choice can significantly affect the total cost. Additional costs may include ductwork, removal of old systems and permits. Fujitsu. Indoor unit: ASYG07KGTE. Outdoor unit: AOYG07KGCA. Cooling capacity (kW). 2,0. Heating capacity (kW). 2,5. Efficiency (cooling). A+++. Carrier and Trane are probably the most reliable when installed properly. They are built more solid, literally. Since , Trane has led the HVAC industry in developing and manufacturing sustainable HVAC systems that increase your home comfort while lowering your energy. In this article, we walk you through the pros and cons of each of the units and systems to help you decide on the best option for your home. Each has its own specialized uses, but they all essentially do the same thing – make it cool inside your home. The type of cooling system that works best for. American Standard is the best overall HVAC company on this year's list, but all of the brands featured here offer reliable equipment – some at an affordable. ENERGY STAR certified air conditioners have higher seasonal energy efficiency ratio (SEER) and energy efficiency ratio (EER) ratings. A central air conditioner. Every one of these air conditioning brands is an excellent choice for your home. Lennox, Trane, or Amana are the brands to consider if you want the most.

Window air conditionersare popular because they are affordable and easy to install. These air conditioning units are suitable for a small bedroom, guest room or. Goodman is one of the biggest names in home cooling, heating and energy-efficient home comfort. That's because Goodman lives up to its name in a big way. Bosch in general makes good stuff. Anything with the Bosch name is probably pretty good quality. Carrier tops our list of the best AC brands with out of 5 stars. Read about how we reviewed the best AC brands on features, reliability and warranties. Central air conditioning pros. A central AC system is the most efficient way to keep your entire home cool. This system ensures that you lower energy bills. Lennox, Trane, or Amana are the brands to consider if you want the most efficient option. If cost is your biggest concern, Frigidaire or Rheem may be the best. FIOGOHUMI BTU Portable Air Conditioners - Portable AC Unit with Built-in Dehumidifier Fan Mode for Room up. Exacting precision makes Lennox air conditioners among the quietest and most energy-efficient units you can buy. It can switch betweenamong these modes to better control the temperature and humidity. Though an AC unit with a two-stage compressor will be more expensive to. List of Top Manufacturing Companies in the Air Conditioning System Industry · Carrier Corporation · Trane Technologies · York · Rheem Manufacturing · Daikin · Nortek. In this article, we take a look at the pros and cons of each unit or system to help you decide which is the best option for your home. 9 Different Types of Air Conditioners: Choosing the Best AC for Your Home · Window Air Conditioners · Central Air Conditioner · Ductless Mini-Split · Portable Air. Rated 4 Stars & Above · Universal Series Split System 24, BTU 2-Ton 20 Seer Heat Pump and Air Handler · 24, BTU 2 Ton 18 SEER Ducted. These systems have an indoor air handler that pushes cooled air throughout a home's ductwork and an outdoor condenser that houses the compressor, evaporator. system better insulation. Experience a cool and comfortable home with this ROYALTON® 14 SEER sweat air conditioning system which is designed and approved for. This is a fairly new category of smart home devices, but we've tested and reviewed several excellent models over the last decade. The GE ClearView PHNT10 is our. Bring Quality Home The Coleman® brand is trusted across the country for quality and performance. With impressive efficiency, rugged dependability and best-in-. Amana brand central air conditioning systems are designed to be perfect for any home. Even on the hottest days of the year, they can keep a home cool and. Choosing the right one for your home size, construction, and the climate of your area is important. Here are six common types of systems to consider. Learn about air conditioning units by American Standard that offer energy savings for your home air conditioner can better cool your home and save energy.

Mortgage Refinance Rates Iowa

Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Term & (Number of Payments). Rate. Origination Fee. APR. Monthly Payment ; 30 year ( Payments). %. $ %. $ ; 15 year ( Payments). Compare Iowa mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Current Home Loan Rates in Iowa: Click to see Year, Year Fixed, VA, & IFA Mortgage Rates ; Year Fixed. %, % ; VA. %, % ; IFA, IFA. year FHA loans: % with point (previous week: % with point). Mortgage Rate Trends, Past 3 Months. YR Fixed, The average Iowa mortgage was $, compared to the national average of $, Getting pre-approved will help you determine what size mortgage you can. Program, Rate. FirstHome, Program: FirstHome Rate: FirstHome Plus, Program: FirstHome Plus Rate: FirstHome w/ 2nd Loan, Program: FirstHome w/. The mortgage rates in Iowa are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 25 You should be able to find an Iowa mortgage right now with rates somewhere between % and %. You can expect increased demand by people trying to purchase. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Term & (Number of Payments). Rate. Origination Fee. APR. Monthly Payment ; 30 year ( Payments). %. $ %. $ ; 15 year ( Payments). Compare Iowa mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Current Home Loan Rates in Iowa: Click to see Year, Year Fixed, VA, & IFA Mortgage Rates ; Year Fixed. %, % ; VA. %, % ; IFA, IFA. year FHA loans: % with point (previous week: % with point). Mortgage Rate Trends, Past 3 Months. YR Fixed, The average Iowa mortgage was $, compared to the national average of $, Getting pre-approved will help you determine what size mortgage you can. Program, Rate. FirstHome, Program: FirstHome Rate: FirstHome Plus, Program: FirstHome Plus Rate: FirstHome w/ 2nd Loan, Program: FirstHome w/. The mortgage rates in Iowa are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 25 You should be able to find an Iowa mortgage right now with rates somewhere between % and %. You can expect increased demand by people trying to purchase.

Choose loan type · Mortgage Rate Trends · Compare Mortgage Refinance Offers · Lower Your Interest Rate · Shorten Your Loan Term · Leverage Your Home's Equity · Iowa. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. $1,/mo. A $1, monthly payment assumes $, loan amount at % (Median Interest Rate) over months. The current average year fixed mortgage rate in Iowa remained stable at %. Iowa mortgage rates today are 5 basis points higher than the national average. The law defines refinancing as paying one loan by getting a new loan. When you get the new loan, the law says that the lender must give you information about. North Liberty, IA ; or ; Routing Number #; If you are using a screen reader or other assistive device or technology. Today's mortgage rates in Des Moines, IA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Current Rates ; Loan Amount, Rate, APR ; $,, %, % ; $,, %, % ; $,, %, %. Fixed Rate. If you're looking for consistent monthly payments of principal and interest during the life of your loan, a fixed rate mortgage is easier to. Currently rates in Iowa are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. View our year and year mortgage loan rates for new purchases and refinancing. Get prequalified for a mortgage loan with Veridian today. Purchase Fixed Rate Mortgages ; 30 Year, %, % ; 20 Year, %, % ; 15 Year, %, % ; 10 Year, %, %. On the week of July 31, , the current average interest rate for a year fixed-rate mortgage increased 1 basis points from the prior week to %. The. Compare today's mortgage rates for Iowa The current mortgage rates in Iowa stand at % for a year fixed mortgage and % for a year fixed. The average Iowa mortgage rate for a fixed year mortgage is % (Zillow, Feb. ). Iowa Jumbo Loan Rates. If you need to take out a loan that exceeds. Purchase rates often differ from refinance rates. In Iowa, the average APR for a year fixed-rate mortgage is %, while the refinance APR for the same loan. rate mortgage loans, first-time home buyer loans and home equity loans ISB offers competitive long term interest rates, fixed rates, balloon rates, and. Current 30 year-fixed mortgage refinance rates are averaging: %. Mortgage Rates. Competitive Rates. Unmatched Service. ; 30 Year Fixed Rate Loan 30 Day Lock* · %, %, , $ ; 15 Year Fixed Rate Loan 30 Day Lock*.

Chase Private Bank Mortgage Rates

A 3% down payment on a year, fixed-rate loan of $, with an interest rate of % / % APR will have monthly principal and interest payments. Bank with us and you can open a Chase saver account – you'll earn % AER (% gross) variable interest daily, and we'll pay it monthly¹. With instant. We offer our US clients highly competitive rates for jumbo mortgages with a range of features and benefits. The interest rate with variable rate mortgages will fluctuate with Meridian Prime Rate, which is currently %. Where applicable, the Bank of Canada. We offer our US clients highly competitive rates for jumbo mortgages with a range of features and benefits. Chase online; credit cards, mortgages, commercial banking, auto loans, investing & retirement planning, checking and business banking. Chase quoted me % for a year fixed, and can offer a % discount if I become a Chase Private Client. Your Chase loan number is available on your monthly Chase loan statements. You can also visit First Republic Banking Online to log in to your account and view. An interest rate is the cost of borrowing money from a bank or lender. The rate determines how much you owe back to your lender, on top of the money you have. A 3% down payment on a year, fixed-rate loan of $, with an interest rate of % / % APR will have monthly principal and interest payments. Bank with us and you can open a Chase saver account – you'll earn % AER (% gross) variable interest daily, and we'll pay it monthly¹. With instant. We offer our US clients highly competitive rates for jumbo mortgages with a range of features and benefits. The interest rate with variable rate mortgages will fluctuate with Meridian Prime Rate, which is currently %. Where applicable, the Bank of Canada. We offer our US clients highly competitive rates for jumbo mortgages with a range of features and benefits. Chase online; credit cards, mortgages, commercial banking, auto loans, investing & retirement planning, checking and business banking. Chase quoted me % for a year fixed, and can offer a % discount if I become a Chase Private Client. Your Chase loan number is available on your monthly Chase loan statements. You can also visit First Republic Banking Online to log in to your account and view. An interest rate is the cost of borrowing money from a bank or lender. The rate determines how much you owe back to your lender, on top of the money you have.

Earn up to % off your rate. ; $, ‒ $,, % ; $1,, or more, %.

Many ways to finance or refinance a jumbo loan. Jumbo mortgages typically are for larger loan amounts not covered by conforming loan limits. We offer flexible. Chase Private Client customers get a % discount on auto financing with J.P. Morgan Chase Bank. You can only apply for this rate online, but the rate is not. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. You can lower your rate based on your existing Chase deposits and J.P. Morgan investments. See our current mortgage rates, low down payment options, and jumbo. As a Chase Private Client, there are many benefits and features available to you: preferred rates for home and auto loans, access to CD ladders and more. To get private mortgage rates, you'll be in a jumbo ARM. Usually year fixed, then adjustable annually. That's the only stuff the banks can keep in their. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Wealth Management accounts can save off the standard mortgage rate. For Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC. Average rates from other lenders · % · % · $1, · $ · % · % · $1, · $2, Check auto loan rates NEED TO MEET WITH US? Schedule an appointment · Bank of America Private Bank can help you manage the complexities of substantial wealth. Use our mortgage calculator to get a customized estimate of your mortgage rate and monthly payment. Try our Home Value Estimator to discover your home's value. private banking businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates. Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC. See our current mortgage rates, low down payment options, and jumbo mortgage loans. Mortgage rates have fallen to the lowest level since mid-March , with the year fixed rate hitting %. Chase Home Lending head of consumer originations. Chase Private Client customers get a % discount on auto financing with J.P. Morgan Chase Bank. You can only apply for this rate online, but the rate is not. Bank of America provides a % to % origination fee reduction or interest rate reduction on purchase and refinance mortgages. Chase offers a %. At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $1, at an interest rate of %. Welcome to TD Bank! Explore our banking services, credit cards, loans, home lending, and other financial products for you and your business. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. First Republic now a part of JPMorgan Chase, and its subsidiaries offer private banking, business banking and private wealth management.

Best Companies For Student Loan Consolidation

Overview: SoFi is one of the most popular lenders for borrowers looking to refinance their student loans, and it's easy to see why. The lender has a wide range. Consolidation loans are available for most federal loans, including Stafford, PLUS and SLS, FISL, Perkins, Health Professional Student Loans, NSL, HEAL. Pay less on student loans, get more out of life with Credible. No impact to credit score. Lower your monthly payment with rates as low as %! Refinance federal student loans and private loans from other lenders today with the Brazos student loan refinance program. We can help you determine the best. Pre-qualify with 17+ lenders to refinance your student loans through a single form in as little as three minutes. Splash Financial is a leader in student loan refinancing for doctors. They also offer a special refinancing program for residents and fellows, which allows you. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! The best student loan refinance company for you is the one that offers terms that align with your goals. Current interest rates are as low as %. Compare. Top lender interest rates ; SoFi Student Loan Refinancing. · Check rate on SoFi's website. on SoFi's website. %. ; LendKey Student Loan. Overview: SoFi is one of the most popular lenders for borrowers looking to refinance their student loans, and it's easy to see why. The lender has a wide range. Consolidation loans are available for most federal loans, including Stafford, PLUS and SLS, FISL, Perkins, Health Professional Student Loans, NSL, HEAL. Pay less on student loans, get more out of life with Credible. No impact to credit score. Lower your monthly payment with rates as low as %! Refinance federal student loans and private loans from other lenders today with the Brazos student loan refinance program. We can help you determine the best. Pre-qualify with 17+ lenders to refinance your student loans through a single form in as little as three minutes. Splash Financial is a leader in student loan refinancing for doctors. They also offer a special refinancing program for residents and fellows, which allows you. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! The best student loan refinance company for you is the one that offers terms that align with your goals. Current interest rates are as low as %. Compare. Top lender interest rates ; SoFi Student Loan Refinancing. · Check rate on SoFi's website. on SoFi's website. %. ; LendKey Student Loan.

Generally there are three types of student loan refinancing companies. Some companies, like Earnest offer refinancing by selling commercial paper in the credit. Best Private Student Loans · Best Student Loan Refinance Companies · Student Loans Without Co-Signer · Best International Student Loans · Best Parent Student Loans. Finance your education with a private student loan through ELFI. From private student loans to refinancing options for college and graduate school. Student loan consolidation most often refers to the federal program. Student loan refinancing usually refers to programs offered by private lenders. What is. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! Best 3 Credit Unions for Student Loan Refinancing ; 1. PenFed. PenFed offers fixed-rate refinance loans with low rates. ; 2. Navy Federal Credit Union. Navy. Best place to refinance student loans · Citizens Bank: No degree requirement and co-signer release after 36 payments, but higher rate ceilings. Looking to refinance a student loan? It's important to shop around for the best interest rate, fees, terms and conditions to suit your needs. Federal Student Loans. Federal student loans are the easiest and most beneficial to consolidate because they offer low interest rates, increased payback terms . FSA uses servicers (private companies) like Edfinancial Services to manage billing, questions, and payments, and to help you enroll in the best repayment plan. Earnest is on this list because it's one of the most flexible student loan refinancing companies - they offer the ability to pick any monthly payment and term. whatever gives you the best rate, I went with Commonbond. I used one of the websites like Credible that put your information into a bunch of. Cedar Education Lending Private Student Loan Consolidation · Darien Rowayton Bank (DRB) · Independent Community Bankers of America (ICBA) · Navy Federal Credit. Best Student Loan Refinancing Companies. Lender, Rating, Fixed APR, Variable APR, Apply. Lender RISLA, Rating A, Fixed APR % – %, Variable APR None. consolidation and student loan refinancing and find out which one is best for you student loan refinance companies as possible to find the right loan. Compare student loan consolidation interest rates from top lenders ; Citizens · · ; ELFI · · ; EdvestinU · · As you compare student loan consolidation companies, the credit counselors at American Consumer Credit Counseling (ACCC) can provide valuable information to. Second, the best student loan consolidation companies for federal student loans are not really companies at all. Your best student loan consolidation option for. Compare the best student loan refinance lenders ; Laurel Road. % to % ; SoFi. % to %* ; RISLA. % to % ; College Ave. % to %. Our Picks for the Best Student Loan Refinancing Companies ; % – % APR · 5, 7, 10, 15, or 20 years · · % – % APR · 5, 7, 10, 15, or 20 ; % –.

1 2 3 4 5